Life insurance benefits offer a crucial safety net for families and individuals, providing financial security during life’s most challenging moments. Understanding the various types of life insurance, from term life to whole life policies, is the first step towards making informed decisions about your financial well-being. This exploration delves into the multifaceted aspects of life insurance, examining its benefits, riders, application processes, and tax implications, ultimately empowering you to choose the best coverage for your unique circumstances.

This guide aims to demystify the complexities of life insurance, providing a clear and comprehensive understanding of its various components. We will explore the different policy options available, discuss how beneficiaries receive benefits, and examine the factors that influence premium costs. Furthermore, we will address the tax implications and provide illustrative examples of how life insurance has positively impacted families in times of need. The goal is to equip you with the knowledge necessary to make informed decisions and secure a financially stable future for yourself and your loved ones.

Types of Life Insurance

Choosing the right life insurance policy can be a complex decision, as various types cater to different needs and financial situations. Understanding the features, benefits, and costs of each type is crucial for making an informed choice. This section will Artikel several common types of life insurance policies, highlighting their key characteristics.

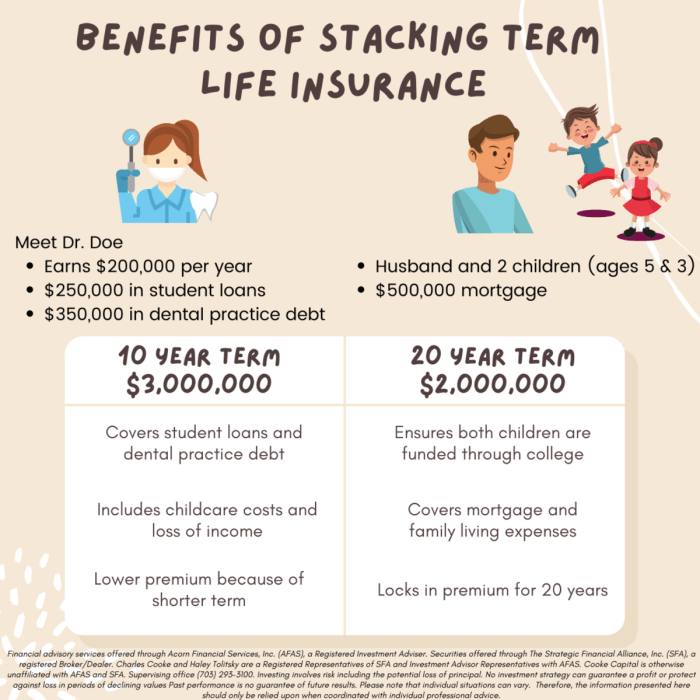

Term Life Insurance

Term life insurance provides coverage for a specific period, or “term,” such as 10, 20, or 30 years. If the policyholder dies within the term, the beneficiaries receive the death benefit. If the policyholder survives the term, the coverage ends, and there is no cash value. Term life insurance is generally the most affordable type of life insurance, making it a popular choice for those needing temporary coverage, such as during periods of high debt or while raising young children. Premiums remain level throughout the term. The simplicity and affordability make it a straightforward option for many.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning the death benefit is payable whenever the insured dies, regardless of when that occurs. Unlike term life insurance, whole life insurance builds cash value over time, which grows tax-deferred. Policyholders can borrow against this cash value or withdraw it, though this will reduce the death benefit. Whole life insurance is typically more expensive than term life insurance due to the lifelong coverage and cash value component. It’s often seen as a long-term investment and legacy planning tool.

Universal Life Insurance

Universal life insurance offers flexible premiums and a death benefit that can be adjusted over time. Similar to whole life insurance, it builds cash value, but the growth rate is variable and depends on the interest rates earned on the cash value. Policyholders can adjust their premium payments within certain limits and can also increase or decrease the death benefit. This flexibility makes it suitable for those whose income or needs may change over time. However, this flexibility also means that the policy can become more expensive if interest rates fall.

Variable Life Insurance

Variable life insurance also allows for flexible premiums and a variable death benefit, but the cash value grows based on the performance of the underlying investment options chosen by the policyholder. This means that the cash value can grow more quickly than with universal life insurance, but it can also decline if the investments perform poorly. This higher risk is balanced by the potential for greater returns. It requires a higher degree of investment knowledge and risk tolerance.

Comparison of Life Insurance Policy Types

The following table summarizes the key features of the four types of life insurance discussed above:

| Feature | Term Life | Whole Life | Universal Life | Variable Life |

|---|---|---|---|---|

| Coverage Period | Specific Term (e.g., 10, 20, 30 years) | Lifelong | Lifelong | Lifelong |

| Premiums | Level | Level | Flexible | Flexible |

| Cash Value | None | Yes, grows tax-deferred | Yes, variable growth | Yes, variable growth based on investment performance |

| Death Benefit | Fixed | Fixed | Adjustable | Variable |

| Cost | Generally Low | Generally High | Moderate to High | Moderate to High |

Suitability of Different Policy Types for Life Stages

The ideal life insurance policy varies greatly depending on individual circumstances and life stage. Young adults with limited financial resources and a need for basic coverage may find term life insurance sufficient. Families with young children and significant financial responsibilities may benefit from higher coverage amounts offered by universal life or whole life policies, even though the premiums are higher. Individuals nearing retirement may consider adjusting their coverage based on their reduced financial obligations and assets. Those with a high risk tolerance and investment knowledge may find variable life insurance attractive, though it carries more investment risk. The suitability of each policy should be carefully considered in consultation with a financial advisor.

Benefits for Beneficiaries

Life insurance policies are designed to provide financial security to designated beneficiaries after the death of the insured. The payout, or death benefit, can significantly alleviate the financial burdens often associated with loss and provide crucial support for the future. The way beneficiaries receive these benefits can vary depending on the policy and the choices made by the insured.

Beneficiaries receive life insurance benefits in several ways, offering flexibility to meet diverse needs. The most common method is a lump-sum payment, providing a large, immediate cash infusion. Alternatively, beneficiaries may opt for a structured settlement, receiving payments over a predetermined period. This can provide a more manageable stream of income, particularly helpful for long-term financial planning. Less common options may include a combination of lump-sum and structured payments, or even the purchase of an annuity that provides regular income for a specified duration.

Lump-Sum Payments

A lump-sum payment delivers the entire death benefit at once. This approach offers immediate access to funds, which can be vital for covering immediate expenses such as funeral costs and outstanding debts. For example, a family facing the unexpected death of a primary breadwinner might use a lump-sum payment to settle outstanding mortgage payments, medical bills, and funeral expenses, preventing further financial strain during an already difficult time. The speed and simplicity of this method make it a popular choice for many beneficiaries.

Structured Settlements

Structured settlements provide a series of payments over a defined period, such as monthly or annually. This method offers a more controlled and sustainable flow of income, mitigating the risk of quickly depleting a large sum of money. Imagine a scenario where a young family loses a parent. A structured settlement could provide a regular income stream to cover mortgage payments, children’s education expenses, and daily living costs over many years, ensuring financial stability without the immediate pressure of managing a large sum. The length and frequency of payments are tailored to the beneficiary’s needs and the terms of the life insurance policy.

Life Insurance Benefits in Action: A Hypothetical Scenario

Consider a family where the primary breadwinner, earning $75,000 annually, passes away unexpectedly. They have a mortgage of $250,000, outstanding student loans of $50,000, and two young children. Without life insurance, the family would face significant financial hardship. However, with a $500,000 life insurance policy, the death benefit could be used to pay off the mortgage and student loans, leaving a substantial amount to cover living expenses and the children’s education. The beneficiaries could choose a lump-sum payment to immediately address the debts or opt for a structured settlement to provide a consistent income stream for years to come, ensuring the family’s financial security and stability. This demonstrates how life insurance can act as a crucial safety net, protecting loved ones from financial ruin in the face of unexpected loss.

Life Insurance Riders and Add-ons

Life insurance riders and add-ons offer policyholders the opportunity to customize their coverage and enhance its value beyond the basic death benefit. These optional additions provide protection against specific events or needs, allowing for a more tailored and comprehensive insurance plan. Understanding the various riders available is crucial for making informed decisions about your life insurance policy.

Many riders are available, each designed to address a particular concern or life stage. Common examples include accidental death benefit riders, critical illness riders, and long-term care riders. The selection of appropriate riders depends heavily on individual circumstances, financial goals, and risk tolerance. Carefully weighing the costs and benefits of each rider is essential before adding them to your policy.

Accidental Death Benefit Rider

This rider provides an additional death benefit payment if the insured dies as a result of an accident. The payout is typically a multiple of the policy’s face value, offering financial security to beneficiaries in the event of a sudden and unexpected loss. For example, a policy with a $500,000 death benefit and a double indemnity accidental death benefit rider would pay out $1,000,000 if the insured died in an accident. This rider can provide peace of mind for individuals in high-risk professions or those with active lifestyles.

Critical Illness Rider

A critical illness rider provides a lump-sum payment upon diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. This payment can be used to cover medical expenses, lost income, or other financial burdens associated with a serious illness. The payout is typically a percentage of the policy’s face value, and the specific illnesses covered vary by insurer. For instance, a policy with a $250,000 face value and a critical illness rider paying 50% of the face value would provide a $125,000 payout upon diagnosis of a covered illness. This rider can significantly alleviate financial stress during a challenging time.

Long-Term Care Rider

A long-term care rider provides coverage for long-term care expenses, such as nursing home care or home healthcare services. This rider can help protect your assets and ensure you receive the necessary care without depleting your savings. The benefits are typically paid as a daily or monthly allowance, up to a specified limit. The benefit amount and duration of coverage vary depending on the rider’s terms. For example, a rider might provide $100 per day for up to three years of long-term care. This rider is particularly beneficial for individuals concerned about the rising costs of long-term care.

Comparison of Three Riders

The following table compares the costs and benefits of the three riders discussed above. It is important to note that the actual costs and benefits will vary depending on the insurer, the policy, and the individual’s circumstances.

| Rider | Cost | Benefits | Circumstances Where Most Beneficial |

|---|---|---|---|

| Accidental Death Benefit | Relatively low premium increase | Additional death benefit in case of accidental death | Individuals in high-risk professions, active lifestyles |

| Critical Illness Rider | Moderate premium increase | Lump-sum payment upon diagnosis of a critical illness | Individuals concerned about the financial burden of a serious illness |

| Long-Term Care Rider | Significant premium increase | Coverage for long-term care expenses | Individuals concerned about the rising costs of long-term care |

Factors Affecting Life Insurance Premiums

Understanding the factors that determine your life insurance premium is crucial for making informed decisions. Several key elements contribute to the final cost, and their interplay significantly impacts the overall price you pay. This section will Artikel these factors and their relative importance in calculating your premium.

The cost of your life insurance premium is a complex calculation based on a variety of factors, each contributing to the insurer’s assessment of your risk. These factors are weighed and analyzed to determine the likelihood of the insurer having to pay a death benefit. A higher perceived risk translates to a higher premium.

Age

Age is arguably the most significant factor influencing life insurance premiums. Statistically, the older a person is, the higher the risk of mortality. Insurance companies use actuarial tables, based on extensive mortality data, to calculate the probability of death within a specific timeframe. As you age, this probability increases, leading to higher premiums. For example, a 30-year-old applying for a policy will generally receive a much lower premium than a 50-year-old, all other factors being equal. This is because the 50-year-old is statistically more likely to pass away within the policy’s duration.

Health

An applicant’s health status significantly impacts premium calculations. Individuals with pre-existing conditions, such as heart disease, diabetes, or cancer, are considered higher risk and will typically face higher premiums. Insurers often require medical examinations and may request access to medical records to assess the applicant’s overall health. Conversely, those with excellent health and a history of healthy lifestyle choices can often secure lower premiums. For instance, someone with a family history of heart disease might receive a higher premium than someone with a clean bill of health.

Lifestyle

Lifestyle choices also play a significant role in determining premiums. Factors such as diet, exercise habits, and participation in high-risk activities (e.g., skydiving, extreme sports) are all considered. Insurers recognize that individuals engaging in unhealthy lifestyles have a greater chance of experiencing health problems, thus increasing the risk of early death. Consequently, maintaining a healthy lifestyle can lead to lower premiums. A person who regularly exercises and maintains a healthy weight is likely to receive a more favorable rate than someone who smokes and is obese.

Smoking Habits

Smoking is a particularly significant risk factor and often results in substantially higher premiums. Smokers are at a significantly increased risk of various health problems, including lung cancer, heart disease, and respiratory illnesses, all of which increase the likelihood of an early death. Insurers recognize this increased risk and adjust premiums accordingly. The impact of smoking on premiums can be substantial, often resulting in premiums significantly higher than those for non-smokers. Quitting smoking can lead to lower premiums over time, as many insurers offer discounts or lower rates after a certain period of abstinence.

Policy Type

The type of life insurance policy chosen also impacts the premium. Term life insurance, which provides coverage for a specific period, generally has lower premiums than permanent life insurance, which offers lifelong coverage. Within permanent life insurance, different types, such as whole life or universal life, also have varying premium structures. Whole life policies, for example, usually have higher premiums than universal life policies due to the guaranteed cash value component. The choice of policy reflects the individual’s needs and risk tolerance, directly impacting the premium paid.

The Application and Underwriting Process: Life Insurance Benefits

Securing life insurance involves a multi-step process, beginning with the application and culminating in the insurer’s risk assessment. Understanding this process empowers you to navigate it effectively and obtain the most suitable coverage. This section details the steps involved in applying for life insurance, the policy selection process, and how insurers determine your premium.

Applying for life insurance typically starts with completing an application form. This form requests extensive personal and health information, including details about your medical history, lifestyle, and occupation. Accuracy is paramount; providing false information can lead to policy rejection or even legal repercussions. After completing the application, you may be required to undergo a medical examination, involving blood tests, urine samples, and a physical assessment. This examination allows the insurer to gather further data to assess your health status and risk profile. The extent of the medical examination will vary depending on the policy amount and your health history.

The Application Process

The application process usually begins with contacting an insurance agent or directly applying online. The application form will ask for detailed personal information, such as your age, address, occupation, and family medical history. You’ll also need to specify the desired coverage amount and policy type. Be prepared to provide accurate and complete information. Following submission, the insurer will review your application and may request additional documentation or a medical examination.

Choosing the Right Life Insurance Policy

Selecting the appropriate life insurance policy requires careful consideration of your individual needs and circumstances. Factors such as your age, health, financial goals, and family responsibilities all play a crucial role. For example, a young, healthy individual with a young family might prioritize a term life insurance policy for its affordability and high coverage, while an older individual nearing retirement might prefer a whole life policy for its long-term value and cash value accumulation. It is advisable to consult with a financial advisor to determine the most suitable policy based on your specific situation.

The Underwriting Process

Underwriting is the process by which insurers assess the risk associated with insuring an individual. Insurers use a variety of factors to determine the level of risk, including your age, health history, lifestyle, occupation, and family medical history. They review your application, medical examination results (if applicable), and may conduct additional investigations. Based on this assessment, they determine your premium rate, reflecting the perceived level of risk. Individuals with a lower risk profile, such as those with excellent health and a healthy lifestyle, generally qualify for lower premiums. Conversely, individuals with higher risk profiles may face higher premiums or even be denied coverage. For instance, a smoker may receive a higher premium than a non-smoker due to the increased risk of health complications. This process ensures that premiums are fairly distributed based on the individual’s risk profile.

Tax Implications of Life Insurance Benefits

Understanding the tax implications of life insurance is crucial for both policyholders and beneficiaries. The tax treatment of death benefits can vary significantly depending on several factors, including the type of policy, the beneficiary’s relationship to the policyholder, and how the benefits are paid out. Failing to understand these implications can lead to unexpected tax liabilities.

Life insurance death benefits are generally received income tax-free by the beneficiary. This is a significant advantage, as it allows the beneficiary to receive the full amount of the death benefit without having to pay income taxes on it. However, there are exceptions to this rule, and certain situations can trigger tax implications.

Tax-Free Death Benefits

Generally, death benefits paid to a named beneficiary are excluded from the beneficiary’s gross income and are therefore not subject to federal income tax. This applies to most life insurance policies, regardless of whether they are term life, whole life, or universal life insurance. This tax-free status is a key reason why many people purchase life insurance. The exception to this is if the policy was purchased with borrowed funds and the death benefit is used to pay off the loan. In that case, the death benefit is reduced by the loan amount, and the remaining amount is tax-free.

Taxable Situations Involving Life Insurance Death Benefits

While most death benefits are tax-free, certain situations can lead to tax implications. For example, if the policy was transferred to a third party for valuable consideration, the death benefit may be subject to income tax. This situation typically occurs when a policy is sold to a viatical settlement company. Additionally, if the policy is assigned to a creditor as collateral, any amount exceeding the outstanding loan is usually tax-free to the beneficiary, while the loan repayment itself is not taxable.

Tax Implications for Policyholders

Policyholders generally don’t pay income taxes on the premiums they pay. However, if the policyholder takes out a loan against the cash value of a permanent life insurance policy, the loan itself isn’t taxed. However, if the policyholder withdraws the cash value or surrenders the policy, any gains above the premiums paid are considered taxable income. This is important to consider, as it can impact the overall tax efficiency of the policy. For instance, a policyholder with a whole life insurance policy that has accumulated significant cash value might face a significant tax liability if they withdraw a substantial amount.

Examples of Tax Treatment Based on Beneficiary Relationship

The relationship between the policyholder and the beneficiary can also affect the tax implications. For example, if the beneficiary is a spouse, the death benefit is generally tax-free. However, if the beneficiary is a business entity, certain situations may result in tax implications for the business. Similarly, if the policy is owned by a trust, the tax treatment will depend on the type of trust and its provisions. The complexity increases significantly when dealing with trusts, highlighting the need for professional financial advice.

Transfer for Value

A policy that is transferred to a third party for valuable consideration (something of monetary value) may be subject to income tax upon the death of the insured. This typically happens when a policy is sold, rather than inherited. The death benefit received by the new owner would be subject to income tax to the extent that it exceeds the amount paid for the policy. This is a key consideration for those contemplating selling their life insurance policies.

Illustrative Examples of Life Insurance in Action

Life insurance, while often viewed as a complex financial product, ultimately provides crucial financial security for families during times of immense grief and uncertainty. The following scenarios demonstrate the tangible and emotional benefits life insurance can offer in diverse situations.

Scenario 1: Sudden Death of a Breadwinner

The Miller family relied heavily on the income of their father, John, a 45-year-old construction worker. John had a $500,000 term life insurance policy, which his employer offered as a benefit. Tragically, John died unexpectedly in a workplace accident. His wife, Sarah, and their two children, aged 10 and 15, were devastated. However, the life insurance payout provided immediate financial relief. The $500,000 covered outstanding mortgage payments, funeral expenses, and provided a substantial fund for Sarah to cover living expenses and her children’s education for years to come. This financial security allowed Sarah to focus on grieving and supporting her children emotionally, rather than being immediately overwhelmed by financial worries. The emotional impact of the loss was profound, but the financial cushion offered by the life insurance significantly eased the burden.

Scenario 2: Long-Term Illness and Disability

The Garcia family faced a different challenge. Maria, a 50-year-old teacher, was diagnosed with a debilitating illness requiring extensive medical treatment and long-term care. Maria had a $250,000 whole life insurance policy with a long-term care rider. This rider provided a monthly benefit to cover her medical expenses and in-home care. While the illness presented significant emotional strain on Maria and her family, the life insurance benefits helped alleviate the immense financial pressure of mounting medical bills and lost income. The whole life policy also provided a death benefit, ensuring financial security for her husband, Ricardo, should she pass away. The combination of the long-term care rider and the death benefit offered comprehensive financial protection during a challenging time.

Scenario 3: Unexpected Business Failure, Life insurance benefits

David, a 60-year-old entrepreneur, poured his life savings into his small business. He secured a $1 million universal life insurance policy, which allowed him to adjust his premiums and death benefit over time as his business grew and his financial needs changed. Unfortunately, an economic downturn led to the unexpected failure of his business. Facing substantial debt and a loss of income, David found himself in a precarious financial position. However, he was able to surrender his universal life insurance policy for a significant cash value payout, providing him with the capital to restructure his finances, pay off some debts, and start over. Although the business failure was a devastating blow, the flexibility of his universal life insurance policy provided a financial lifeline, preventing a complete financial catastrophe. The policy’s cash value helped him avoid bankruptcy and provided a pathway to rebuild his life.

In conclusion, securing adequate life insurance coverage is a vital component of comprehensive financial planning. By carefully considering the various policy types, riders, and factors affecting premiums, individuals can tailor a plan that aligns with their specific needs and circumstances. Understanding the benefits for beneficiaries, along with the tax implications, allows for informed decision-making that protects loved ones from potential financial hardship. Remember, securing your future is an investment in the well-being of those you cherish most.

FAQ

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How much life insurance coverage do I need?

The amount of coverage needed depends on individual circumstances, including outstanding debts, dependents’ needs, and desired lifestyle maintenance for surviving family members. Financial professionals can assist in determining appropriate coverage levels.

Can I change my beneficiary after purchasing a policy?

Yes, most life insurance policies allow you to change your beneficiary at any time by submitting a formal request to the insurance company. Procedures vary by insurer; check your policy documents or contact your insurer directly.

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing, depending on the policy type and the insurer’s grace period. Contact your insurer immediately if you anticipate difficulty making a payment to explore available options.

Are there any health conditions that might disqualify me from getting life insurance?

While some health conditions may affect your eligibility or premium rates, many insurers offer policies for individuals with pre-existing conditions. It is advisable to contact several insurers to compare options.