Liability insurance for businesses is crucial for protecting your assets and reputation. Unexpected accidents, customer injuries, or even professional errors can lead to costly lawsuits. This guide explores the various types of business liability insurance, factors affecting premiums, the claims process, and strategies for effective risk management. Understanding these aspects is key to safeguarding your business from significant financial and reputational damage.

From general liability covering everyday accidents to professional liability protecting against errors in services, the right insurance coverage provides a safety net against unforeseen circumstances. This comprehensive overview will help you navigate the complexities of business liability insurance and make informed decisions to protect your investment.

Types of Business Liability Insurance

Protecting your business from potential financial losses due to liability claims is crucial. Liability insurance safeguards your company against lawsuits stemming from accidents, injuries, property damage, or other incidents related to your business operations. Understanding the different types of liability insurance available is key to selecting the appropriate coverage for your specific needs and risk profile.

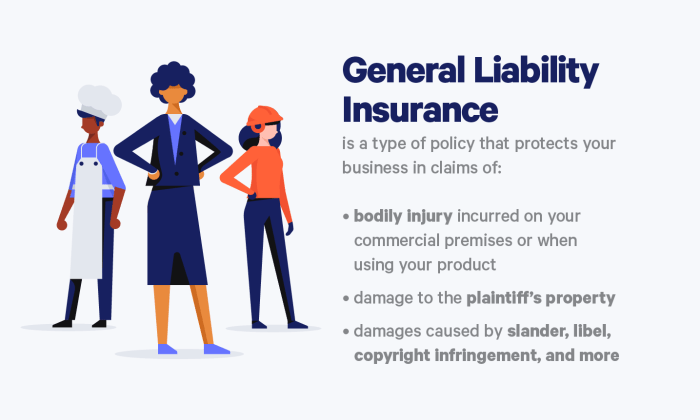

General Liability Insurance

General liability insurance, often called commercial general liability (CGL), is a foundational policy for most businesses. It covers bodily injury or property damage caused by your business operations to third parties. This could include a customer slipping and falling on your premises, damage to a client’s property during a service call, or advertising injury (like libel or slander). General liability insurance typically also includes coverage for medical payments, regardless of fault, to help expedite settlements and mitigate potential legal costs. The policy limits define the maximum amount the insurer will pay for covered claims.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from claims of negligence or mistakes in their professional services. This is vital for businesses offering services like consulting, accounting, design, or legal advice. If a client alleges that your professional services caused them financial harm due to an error or omission, E&O insurance can cover legal fees and potential settlements. It’s important to note that E&O insurance does not cover intentional misconduct or gross negligence.

Product Liability Insurance

Product liability insurance protects businesses that manufacture, distribute, or sell products from claims of injury or damage caused by defective products. If a customer is injured or suffers property damage because of a flaw in your product, this insurance can cover legal costs, settlements, and judgments. This type of coverage is particularly crucial for businesses involved in manufacturing or product distribution, where the risk of product defects and subsequent liability is higher. The policy would typically cover the costs associated with recalling defective products.

Commercial Auto Liability Insurance

Commercial auto liability insurance covers bodily injury or property damage caused by accidents involving company vehicles. This is essential for businesses that utilize vehicles for deliveries, sales calls, or employee commuting. It protects the business from lawsuits arising from accidents involving company-owned or leased vehicles, even if the accident was caused by an employee’s negligence. The coverage extends to accidents that occur while the vehicle is being used for business purposes.

| Insurance Type | Coverage Details | Exclusions | Typical Costs |

|---|---|---|---|

| General Liability | Bodily injury, property damage, medical payments to third parties; advertising injury. | Intentional acts, contractual liability, employee injuries (covered by workers’ compensation), pollution. | Varies greatly based on industry, risk profile, and coverage limits; generally $500-$1500 annually. |

| Professional Liability (E&O) | Claims of negligence or mistakes in professional services resulting in financial harm to clients. | Intentional misconduct, gross negligence, breach of contract (unless specifically covered), prior acts (often available with a prior acts endorsement). | Varies based on profession, risk profile, and coverage limits; typically $500-$3000 annually. |

| Product Liability | Bodily injury or property damage caused by defective products. | Intentional acts, damage to the product itself, recall costs (sometimes covered as an add-on). | Varies widely depending on product type, manufacturing process, and sales volume; can be significant for high-risk products. |

| Commercial Auto Liability | Bodily injury or property damage caused by accidents involving company vehicles during business use. | Damage to the company vehicle itself (requires separate coverage), accidents while the vehicle is used for personal purposes. | Varies based on number of vehicles, driver history, and coverage limits; typically $500-$1500 annually per vehicle. |

Factors Affecting Liability Insurance Premiums

Understanding the factors that influence your business liability insurance premiums is crucial for effective cost management. Insurance companies meticulously assess various aspects of your business to determine the level of risk they are assuming and, consequently, the premium they charge. This evaluation ensures a fair pricing structure that reflects the potential for claims and the insurer’s financial exposure.

Several key elements significantly impact the cost of your liability insurance. These factors are interconnected and often influence each other, creating a complex calculation of risk. A thorough understanding of these factors can empower businesses to make informed decisions to mitigate risk and potentially lower their premiums.

Business Size and Industry

Business size directly correlates with the potential for liability. Larger businesses typically handle more transactions, employ more people, and possess more assets, all increasing the likelihood of incidents leading to liability claims. Similarly, the industry in which a business operates plays a critical role. High-risk industries, such as construction or healthcare, naturally face higher premiums due to the inherent dangers and greater potential for accidents and subsequent lawsuits. For example, a large construction company will pay significantly more than a small bakery due to the increased risk of workplace injuries and property damage. The inherent risk associated with specific industry practices significantly impacts premium calculations.

Claims History

A business’s claims history is a powerful predictor of future risk. Insurers carefully review past claims data, including the frequency, severity, and nature of incidents. A history of frequent or significant claims will inevitably lead to higher premiums, reflecting the increased likelihood of future payouts. Conversely, a clean claims history demonstrates responsible risk management and can result in lower premiums, often accompanied by discounts or favorable rating structures. This is a strong incentive for businesses to implement robust risk management strategies.

Risk Management Practices

Proactive risk management is highly valued by insurance companies. Implementing safety protocols, employee training programs, and thorough risk assessments significantly reduces the likelihood of accidents and claims. Insurers often reward businesses with demonstrably strong risk management programs through lower premiums. Examples include investing in safety equipment, conducting regular safety audits, and providing comprehensive employee training on safe work practices. These actions signal to insurers a commitment to minimizing risk, which translates into lower premiums.

Reducing Liability Insurance Premiums

Businesses can actively work to reduce their liability insurance premiums. This involves a proactive approach to risk management and a careful review of their insurance policies.

Several strategies can contribute to lower premiums:

- Implement robust safety programs and training for employees.

- Conduct regular risk assessments to identify and mitigate potential hazards.

- Maintain detailed records of safety procedures and incident reports.

- Invest in preventative maintenance of equipment and facilities.

- Explore loss control measures, such as security systems and improved safety protocols.

- Shop around and compare quotes from multiple insurers.

- Maintain a clean claims history by addressing incidents promptly and responsibly.

- Consider increasing deductibles to lower premiums (weighing the cost-benefit carefully).

- Bundle insurance policies with the same insurer to potentially secure discounts.

Claims Process and Procedures

Understanding the claims process is crucial for businesses holding liability insurance. A smooth and efficient process can minimize disruption and financial losses following an incident. This section details the steps involved, common claim scenarios, and best practices for handling a claim effectively.

Filing a liability insurance claim involves several key steps, beginning with prompt notification and concluding with a settlement or denial. The specifics can vary depending on your insurer and the nature of the claim, but the general process remains consistent. Effective communication and thorough documentation are paramount throughout.

Steps Involved in Filing a Liability Claim

The process typically begins with immediate notification of the incident to your insurance provider. This is often followed by a detailed claim report, including all relevant information such as dates, times, locations, and involved parties. The insurer will then conduct an investigation, potentially involving interviews and gathering evidence. This investigation helps determine liability and the extent of damages. Once the investigation is complete, the insurer will make a decision regarding coverage and settlement. This decision may involve negotiations with the claimant or their legal representatives. The final step is the settlement of the claim, either through payment or denial of coverage based on policy terms and the investigation’s findings.

Common Scenarios Leading to Liability Claims

Many scenarios can trigger a liability claim for a business. For example, a customer slipping and falling on a wet floor in a retail store could lead to a personal injury claim. A contractor’s negligence causing damage to a client’s property could result in a property damage claim. A product defect causing harm to a consumer could lead to a product liability claim. Similarly, a business’s advertising leading to false claims could result in a claim for advertising injury. These are just a few examples; the potential for liability is broad and depends heavily on the industry and operations of the business.

Handling a Liability Claim Effectively

Prompt and accurate reporting is critical. Immediately notify your insurer of the incident, providing as much detail as possible. Gather and preserve all relevant documentation, including police reports, medical records, witness statements, and photographs of the incident and any damages. Maintain open and clear communication with your insurer throughout the process, responding promptly to their requests for information. Cooperate fully with the insurer’s investigation. Avoid admitting fault or making promises to the claimant without consulting your insurer. Consider seeking legal counsel to protect your interests. Remember that accurate record-keeping and thorough documentation are vital throughout the claims process. These actions can significantly impact the outcome of the claim.

Importance of Adequate Coverage

Insufficient liability insurance coverage can expose businesses to significant financial risks, potentially leading to devastating consequences. The absence of adequate protection can leave a company vulnerable to crippling lawsuits, resulting in the depletion of assets and even bankruptcy. Understanding the true extent of potential liability and securing appropriate coverage is crucial for business survival and long-term stability.

Liability insurance acts as a critical shield, protecting a business’s financial health and reputation. In the event of a lawsuit stemming from an accident, injury, or property damage, the insurance policy covers legal fees, settlements, and judgments up to the policy’s limits. This protection prevents the business from having to use its own funds to cover these potentially massive expenses, safeguarding its assets and preventing financial ruin. Furthermore, a strong liability insurance policy can also protect a business’s reputation by mitigating negative publicity associated with accidents or lawsuits. A swift and effective response, facilitated by insurance coverage, demonstrates responsibility and can help minimize reputational damage.

Financial Consequences of Inadequate Coverage

Inadequate liability insurance can result in substantial financial losses for a business. For instance, a small café with insufficient liability coverage might face bankruptcy if a customer slips and falls, incurring significant medical bills and legal costs exceeding the policy limit. The business would then be responsible for the remaining amount, potentially leading to closure. Larger businesses also face substantial risk; a construction company with insufficient coverage could face ruin from a workplace accident resulting in multiple lawsuits and substantial damages. The financial impact extends beyond direct costs, including potential loss of revenue due to business interruption, reputational damage impacting future contracts, and the cost of hiring legal counsel to navigate complex litigation. The financial burden can be catastrophic, easily exceeding the value of the business itself.

Protection of Business Assets and Reputation

Liability insurance acts as a buffer between a business and potentially crippling financial losses stemming from lawsuits or accidents. By covering legal fees, settlements, and judgments, it safeguards the business’s assets, preventing the sale of equipment, property, or other resources to cover liabilities. Moreover, it allows the business to continue operations without interruption, minimizing revenue loss. A strong liability insurance policy also protects a business’s reputation. Handling claims efficiently and fairly, facilitated by insurance coverage, can help prevent negative publicity and maintain public trust. Conversely, a lack of adequate coverage can lead to negative press, damage to brand image, and a loss of customer confidence, all of which can significantly impact profitability.

Regular Review and Adjustment of Liability Insurance Policies

As a business grows and changes, its liability exposure evolves. Regular review and adjustment of liability insurance policies are essential to maintain adequate coverage. Factors such as increased revenue, expansion into new markets, changes in operations, and the acquisition of new equipment can all impact liability risk. Annual policy reviews allow businesses to assess their current coverage in light of these changes and adjust limits or coverage types as needed. This proactive approach ensures the business remains adequately protected against evolving risks and avoids gaps in coverage that could leave it vulnerable to significant financial losses. Failing to adjust coverage could lead to underinsurance, exposing the business to potentially catastrophic financial consequences.

Liability Insurance and Risk Management

Effective risk management is paramount for businesses seeking to minimize liability exposure and control insurance costs. Proactive strategies significantly reduce the likelihood of incidents leading to claims, ultimately leading to lower premiums and greater financial stability. By identifying and mitigating potential hazards, businesses demonstrate a commitment to safety and responsible operation, factors favorably considered by insurers.

Implementing a comprehensive risk management program involves a multifaceted approach, integrating various strategies to address potential liabilities. This proactive approach not only protects the business financially but also fosters a safer working environment for employees and customers. The benefits extend beyond reduced insurance premiums to encompass enhanced operational efficiency and improved public perception.

Risk Management Techniques and Their Impact on Liability Insurance

Thorough risk assessments are foundational to effective risk management. These assessments involve systematically identifying potential hazards within the business operations, analyzing their likelihood and potential severity, and prioritizing them based on their risk level. For example, a restaurant might assess the risks associated with food handling, slips and falls, and customer injuries. Following this assessment, the restaurant can implement control measures, such as staff training on food safety protocols and regular inspections to ensure a clean and safe environment. This proactive approach significantly reduces the likelihood of accidents and subsequent liability claims, influencing premium calculations positively. Safety training programs for employees further strengthen the risk mitigation strategy. Regular training on safe work practices, emergency procedures, and hazard identification empowers employees to actively contribute to a safer work environment. The implementation of safety protocols, such as regular equipment maintenance, clearly defined safety procedures, and the use of personal protective equipment (PPE), directly reduces the frequency and severity of accidents. For instance, a construction company implementing strict adherence to safety regulations and providing regular safety training to its workers will likely see a decrease in workplace accidents, minimizing liability risks and leading to lower insurance premiums.

Best Practices for Minimizing Liability Exposure, Liability insurance for businesses

A proactive approach to risk management is crucial for minimizing liability exposure. The following best practices represent key strategies for businesses to reduce their risk profile:

- Conduct regular risk assessments to identify and prioritize potential hazards.

- Implement comprehensive safety training programs for all employees.

- Establish and maintain clear safety protocols and procedures.

- Ensure regular maintenance and inspection of equipment and facilities.

- Maintain accurate and thorough records of all safety training, inspections, and incidents.

- Invest in appropriate safety equipment and technology.

- Develop and implement emergency response plans.

- Foster a strong safety culture within the organization, emphasizing employee participation and accountability.

- Regularly review and update risk management strategies to reflect changes in the business environment and regulatory requirements.

- Maintain adequate liability insurance coverage tailored to the specific risks of the business.

Choosing the Right Insurance Provider

Selecting the right liability insurance provider is crucial for protecting your business from financial ruin in the event of a lawsuit. A thorough evaluation process, considering several key factors, will ensure you secure adequate coverage at a competitive price from a reliable and responsive insurer. This involves more than simply comparing premiums; it’s about building a long-term relationship with a company that understands your business needs.

Choosing a reliable and reputable liability insurance provider requires careful consideration of several factors. A comprehensive approach involves assessing the insurer’s financial stability, claims handling process, and customer service reputation, in addition to comparing policy features and pricing. Ignoring these aspects could lead to inadequate coverage or difficulties in receiving timely claim settlements.

Insurer Financial Strength and Stability

Evaluating an insurer’s financial stability is paramount. A financially sound insurer is more likely to be able to pay out claims when needed. You can assess this by checking their ratings from independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These agencies provide detailed financial analyses and assign ratings that reflect the insurer’s ability to meet its obligations. Higher ratings generally indicate greater financial strength and stability. For example, an A+ rating from A.M. Best signifies superior financial strength and ability to meet its ongoing insurance obligations. Lower ratings should raise concerns about the insurer’s long-term viability and ability to pay claims.

Comparison of Services and Offerings

Different insurance providers offer varying levels of service and a range of policy options. Some may specialize in specific industries, offering tailored coverage packages. Others may provide broader coverage but potentially at a higher premium. Consider factors such as the ease of filing a claim, the availability of online tools and resources, and the responsiveness of customer service representatives. For instance, some providers offer 24/7 claims reporting and dedicated account managers, while others may have limited accessibility. A business with a high volume of transactions might benefit from a provider with robust online claim filing capabilities, whereas a smaller business might prioritize personalized customer service.

Factors to Consider When Comparing Insurance Quotes

When comparing quotes, focus on more than just the premium. While premium cost is important, it shouldn’t be the sole deciding factor. Coverage limits, deductibles, and exclusions are equally critical. A lower premium with inadequate coverage can leave your business vulnerable. Furthermore, consider the insurer’s claims handling process, reputation for customer service, and financial stability. For example, two quotes might offer similar premiums, but one might have a significantly lower deductible or broader coverage for specific liabilities relevant to your business. The insurer with the superior claims handling process and reputation for excellent customer service might be a better choice, even if the premium is slightly higher.

Illustrative Scenario: A Small Coffee Shop: Liability Insurance For Businesses

Let’s consider a hypothetical scenario involving “The Daily Grind,” a small, bustling coffee shop in a busy city center. One rainy Tuesday morning, a customer, Ms. Eleanor Vance, slips on a patch of spilled water near the entrance, falls, and suffers a broken wrist.

Ms. Vance subsequently files a claim against The Daily Grind, alleging negligence on the part of the coffee shop for failing to adequately clean up the spill and maintain a safe environment for its customers. This incident highlights the potential for significant liability for even small businesses. The Daily Grind’s liability insurance policy, if properly structured and maintained, would be crucial in managing this situation.

The Coffee Shop’s Liability Insurance Response

The Daily Grind’s liability insurance policy, assuming it has adequate coverage, would respond to Ms. Vance’s claim by covering several aspects of the incident. Firstly, the policy would provide legal representation for the coffee shop owner in defending against the claim. This includes handling all communication with Ms. Vance and her legal team, investigating the incident, and preparing a defense strategy. Secondly, the policy would cover the costs associated with Ms. Vance’s medical expenses, lost wages, and pain and suffering, up to the policy’s limits. Finally, the insurer would handle the settlement negotiations or court proceedings, minimizing the financial burden and legal complexities on the coffee shop owner. The specific coverage details would depend on the policy’s terms and conditions, including the coverage limits and any applicable exclusions.

The Coffee Shop Owner’s Actions

The coffee shop owner’s immediate actions are critical in minimizing the potential impact of the incident. Firstly, the owner should ensure that Ms. Vance receives immediate medical attention. This demonstrates concern and can help mitigate potential legal issues. Secondly, the owner should thoroughly document the incident, including taking photographs of the spilled water, the location of the fall, and any visible injuries. Gathering witness statements is also crucial. This detailed documentation is vital for the insurance claim process. Thirdly, the owner should promptly report the incident to their insurance company, providing them with all relevant information and documentation. This allows the insurer to begin their investigation and start the claims process efficiently. Finally, the owner should cooperate fully with the insurance company’s investigation, providing any requested information and attending any necessary meetings. Avoid admitting fault or making any promises to Ms. Vance without consulting with the insurance company’s legal team.

Securing adequate liability insurance is not merely a cost; it’s a strategic investment in the long-term health and sustainability of your business. By understanding the different types of coverage, factors influencing premiums, and effective risk management strategies, you can significantly reduce your exposure to liability claims. Remember to regularly review your policy and adapt it to the evolving needs of your business. Proactive risk management coupled with appropriate insurance coverage ensures peace of mind and protects your hard-earned success.

FAQs

What happens if my insurance company denies my claim?

If your claim is denied, carefully review the denial letter, understand the reasons provided, and gather any additional evidence to support your case. You may wish to consult with an attorney to explore your options for appealing the decision.

How often should I review my liability insurance policy?

It’s advisable to review your policy annually, or even more frequently if your business experiences significant growth, changes in operations, or significant shifts in risk profile.

Can I get liability insurance if my business has a history of claims?

Yes, but it may be more expensive. Insurance companies consider claims history when assessing risk. Be upfront about your past claims and work with your insurer to implement risk mitigation strategies.

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions) covers claims arising from professional negligence or mistakes in services provided.

How much liability insurance do I need?

The amount of coverage depends on various factors, including your business size, industry, and risk profile. Consulting with an insurance professional is recommended to determine the appropriate coverage amount.