How to compare insurance providers is a crucial skill in today’s complex marketplace. Navigating the world of insurance policies, premiums, and coverage can feel overwhelming, but with a structured approach, you can confidently find the best plan for your needs. This guide will equip you with the knowledge and tools to compare providers effectively, ensuring you secure optimal protection at a competitive price.

From understanding your individual insurance requirements—be it auto, life, or health—to meticulously evaluating provider reputations and policy details, we’ll break down the process step-by-step. We’ll cover obtaining quotes, deciphering policy language, and weighing the importance of price versus coverage. By the end, you’ll be empowered to make informed decisions, securing the best insurance value for your circumstances.

Understanding Your Insurance Needs

Choosing the right insurance is crucial for protecting your financial well-being. Understanding your specific needs and the various types of coverage available is the first step towards making informed decisions. This section will guide you through key factors to consider when selecting insurance policies, highlighting the differences between various coverage options and comparing popular providers.

Key Factors in Choosing Insurance Coverage

Several critical factors influence the selection of appropriate insurance coverage. These factors should be carefully considered to ensure adequate protection aligned with your individual circumstances. Ignoring these factors can lead to inadequate coverage or unnecessary expenses.

- Your Risk Profile: This involves assessing your personal circumstances, such as your age, health, occupation, and lifestyle, to determine your vulnerability to potential risks. A young, healthy individual may have different insurance needs compared to an older person with pre-existing health conditions.

- Your Budget: Insurance premiums can significantly vary depending on the coverage level and provider. It’s essential to balance the desired level of protection with your financial capabilities. A realistic budget ensures you can maintain consistent coverage without undue financial strain.

- Your Future Goals: Your long-term financial objectives, such as retirement planning or protecting your family’s financial future, should influence your insurance choices. For instance, life insurance is crucial for those with dependents, while long-term care insurance becomes increasingly relevant as one ages.

Liability, Collision, and Comprehensive Car Insurance

Auto insurance policies typically include liability, collision, and comprehensive coverage, each addressing different aspects of potential vehicle-related losses. Understanding their distinctions is vital for choosing appropriate protection.

Liability insurance covers damages or injuries you cause to others in an accident. Collision coverage protects your vehicle in case of an accident, regardless of fault. Comprehensive coverage protects against damage not caused by collisions, such as theft, vandalism, or weather-related events. For example, if you cause an accident and injure another driver, your liability coverage would pay for their medical bills and vehicle repairs. If your car is damaged in a collision, collision coverage would pay for the repairs, and if your car is stolen, comprehensive coverage would compensate you for its loss.

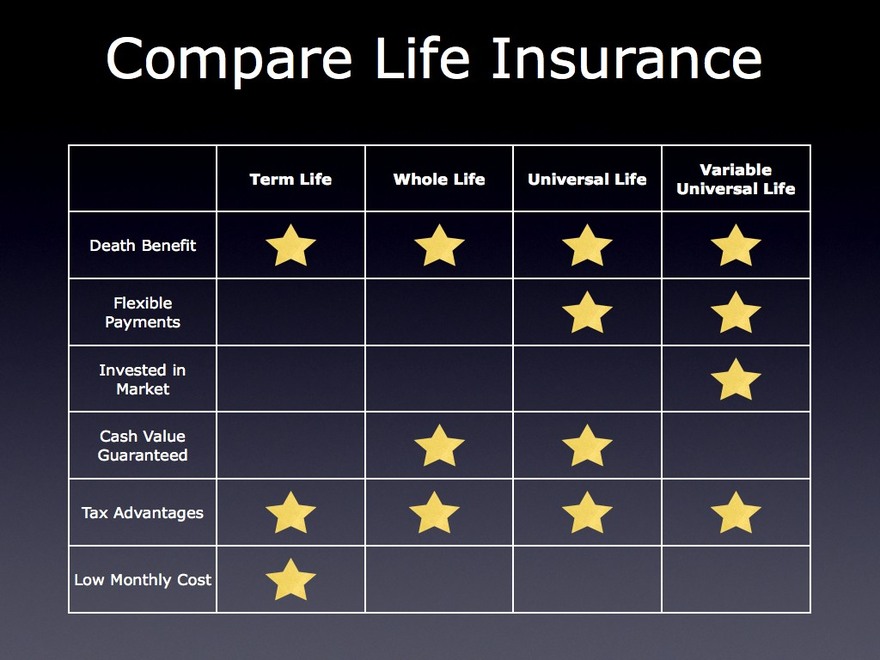

Term Life Insurance vs. Whole Life Insurance

Term life insurance and whole life insurance are two primary types of life insurance, each offering distinct benefits and drawbacks. The choice depends on individual needs and financial goals.

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It’s generally more affordable than whole life insurance but offers no cash value accumulation. Whole life insurance provides lifelong coverage and builds cash value that can be borrowed against or withdrawn. For example, a young family might opt for a 20-year term life insurance policy to cover their mortgage and children’s education, while someone seeking a long-term savings and protection vehicle might choose whole life insurance.

Comparison of Health Insurance Coverage Options

The following table compares coverage options from three major (hypothetical) health insurance providers: Provider A, Provider B, and Provider C. Note that these are illustrative examples and actual provider offerings may vary significantly. Always refer to the provider’s official documentation for accurate and up-to-date information.

| Provider | Deductible | Copay (Doctor Visit) | Out-of-Pocket Maximum |

|---|---|---|---|

| Provider A | $1,000 | $30 | $5,000 |

| Provider B | $2,000 | $40 | $7,000 |

| Provider C | $500 | $25 | $4,000 |

Comparing Prices and Coverage

Choosing the right insurance policy involves careful consideration of both price and coverage. Understanding how these two factors interact is crucial for making an informed decision that best suits your needs and budget. This section will guide you through comparing prices from different providers and understanding the details of their coverage offerings.

Obtaining Insurance Quotes

To compare prices effectively, you need quotes from multiple insurance providers. This involves a straightforward process. First, gather the necessary information, including your age, location, driving history (for auto insurance), and desired coverage levels. Then, visit the websites of several insurance companies or contact their agents directly. Most providers offer online quote tools that allow you to input your information and receive an instant estimate. Alternatively, you can call or email providers to request a quote. Remember to be consistent with the information you provide to each insurer for accurate comparison. Compare quotes carefully, noting the coverage details associated with each price.

Factors Influencing Insurance Premiums

Several factors influence the premiums insurance companies charge. Understanding these factors helps you anticipate the cost and potentially negotiate better rates.

- Your Age and Driving History (for Auto Insurance): Younger drivers and those with poor driving records generally pay higher premiums due to increased risk.

- Location: Insurance premiums vary based on geographic location. Areas with higher crime rates or more frequent accidents tend to have higher premiums.

- Credit Score: In many states, your credit score is a factor in determining your insurance rates. A higher credit score often correlates with lower premiums.

- Type of Vehicle (for Auto Insurance): The make, model, and safety features of your vehicle influence your auto insurance premiums. More expensive or higher-risk vehicles generally lead to higher premiums.

- Coverage Level: The amount of coverage you choose directly impacts your premium. Higher coverage limits typically result in higher premiums.

Deductibles and Co-pays

Deductibles and co-pays are significant components of insurance costs. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, but you’ll pay more if you need to file a claim. Conversely, a lower deductible means a higher premium but lower out-of-pocket costs when a claim is filed. The co-pay is the fixed amount you pay for a covered service, such as a doctor’s visit. Co-pays are usually lower than deductibles and are paid each time you use a covered service. For example, a $1000 deductible with a $30 co-pay means you pay $1000 before insurance covers the rest, and $30 for each doctor’s visit.

Comparing Coverage Details

Comparing coverage details across different insurers is essential to ensure you’re getting the protection you need. A structured approach is recommended.

- Coverage Limits: Compare the maximum amounts each insurer will pay for various covered events (e.g., liability limits for auto insurance, coverage limits for health insurance).

- Covered Services: Carefully review the specific services each policy covers. Some policies may exclude certain treatments or procedures.

- Exclusions and Limitations: Pay close attention to what is *not* covered by each policy. Some policies may have limitations on coverage in specific situations.

- Network Providers (for Health Insurance): If you have a health insurance plan, verify which doctors and hospitals are part of the insurer’s network. Using in-network providers usually results in lower costs.

- Policy Terms and Conditions: Read the policy documents carefully to understand the terms and conditions of each plan. This includes details on claims procedures, cancellation policies, and other important aspects.

Evaluating Provider Reputation and Customer Service: How To Compare Insurance Providers

Choosing an insurance provider involves more than just comparing prices. A thorough evaluation of their reputation and customer service capabilities is crucial for ensuring a positive and stress-free experience, particularly when you need to file a claim. Understanding a provider’s financial stability and their track record in handling customer issues is paramount to making an informed decision.

Provider Financial Stability and Claims-Paying Ability are Key Considerations. A financially sound insurer is more likely to be able to pay out claims promptly and without issue. Conversely, a provider struggling financially may delay or even deny legitimate claims. Investigating a company’s financial ratings from independent agencies like A.M. Best or Moody’s provides valuable insights into their long-term viability and ability to meet their obligations. Looking at a company’s history of claims payouts and customer satisfaction scores can also provide valuable information.

Questions to Ask Potential Insurance Providers, How to compare insurance providers

Before committing to a policy, it’s beneficial to proactively gather information directly from the providers. Asking specific questions allows you to assess their responsiveness and understand their approach to customer service.

- What is your claims process, and what is the average processing time for claims similar to mine?

- What are your customer service hours and available communication channels (phone, email, online chat)?

- What is your customer satisfaction rating, and how do you measure it?

- What is your process for handling complaints and resolving disputes?

- Can you provide references from other clients I can contact to discuss their experiences?

Analyzing Online Reviews and Ratings

Online reviews and ratings offer a valuable window into the experiences of other customers. Websites like Yelp, Google Reviews, and dedicated insurance review platforms provide a wealth of information, allowing you to compare and contrast the customer service experiences across different providers. Remember to critically evaluate the reviews, considering both positive and negative feedback, and looking for patterns or recurring themes. Pay close attention to how providers respond to negative reviews – this demonstrates their commitment to customer satisfaction and problem resolution.

Comparison of Customer Service Ratings

The following table summarizes hypothetical customer service ratings for three major insurance providers. Remember that these are examples and actual ratings may vary.

| Provider | Response Time (Avg.) | Ease of Contact | Overall Customer Satisfaction |

|---|---|---|---|

| Insurer A | 24-48 hours | Easy (multiple channels) | 4.5 out of 5 stars |

| Insurer B | 72 hours | Moderate (phone and email) | 3.8 out of 5 stars |

| Insurer C | 48-72 hours | Difficult (primarily phone) | 3.0 out of 5 stars |

Understanding Policy Details and Fine Print

Before committing to an insurance policy, meticulously reviewing the policy document is crucial. This seemingly tedious task is your safeguard against unexpected costs and limitations down the line. Understanding the fine print ensures you’re fully aware of your coverage, exclusions, and the process for making a claim. Ignoring this step could leave you financially vulnerable in the event of a covered incident.

Common Policy Exclusions and Limitations

Insurance policies, while designed to protect you, often contain exclusions and limitations. These are specific situations or circumstances where coverage is not provided, even if the event falls under the general scope of the policy. Familiarizing yourself with these limitations is vital to making an informed decision about your coverage.

- Acts of God: Many policies exclude damage or loss caused by natural disasters like earthquakes, floods, or hurricanes. While some policies offer supplemental coverage for these events at an additional cost, it’s essential to understand what’s included in your base policy and what requires separate coverage.

- Pre-existing Conditions (Health Insurance): Health insurance policies frequently have limitations on coverage for pre-existing conditions. This means that conditions diagnosed or treated before the policy’s effective date might not be fully covered, or may have a waiting period before coverage begins. Understanding these limitations is critical for individuals with pre-existing health issues.

- Wear and Tear (Home/Auto Insurance): Damage resulting from normal wear and tear is typically excluded from home and auto insurance policies. For example, a cracked windshield due to age and exposure to the elements, rather than an accident, would likely not be covered. Understanding this distinction prevents unrealistic expectations about what your policy covers.

Filing an Insurance Claim

The claims process varies among insurance providers, but generally involves these steps:

- Report the incident promptly: Contact your insurance provider as soon as possible after the covered event occurs. The sooner you report it, the faster the claims process can begin.

- Gather necessary documentation: This might include police reports (in case of accidents), photos of damage, repair estimates, and any other relevant documentation supporting your claim.

- Complete the claim form: Your insurance provider will provide a claim form that needs to be accurately and completely filled out. Be thorough and accurate in your responses.

- Submit your claim: Submit your completed claim form and supporting documentation to your insurance provider, following their instructions for submission (mail, online portal, etc.).

- Follow up: After submitting your claim, follow up with your provider to check on its status. This ensures the process is moving forward efficiently.

Understanding Policy Renewal Terms and Conditions

Before your policy renews, carefully review the renewal notice. This document Artikels the terms and conditions for the upcoming policy period, including any changes in premiums, coverage, or exclusions. Understanding these changes allows you to make informed decisions about continuing your policy.

- Review the premium amount: Check if your premium has increased and understand the reasons for any changes. Increased premiums may reflect changes in risk assessment or market conditions.

- Examine coverage details: Verify that your coverage remains consistent with your needs. Your circumstances might have changed, requiring adjustments to your coverage levels.

- Note any policy changes: Pay close attention to any modifications in the policy terms, exclusions, or limitations. Significant changes might necessitate a reconsideration of your insurance provider.

- Understand the renewal process: Familiarize yourself with the steps involved in renewing your policy. This might involve paying the premium by a specific date or completing additional forms.

Choosing the Right Insurance Provider

Selecting the right insurance provider is a crucial decision impacting your financial well-being. This choice involves careful consideration of various factors, balancing cost-effectiveness with the level of protection offered. Understanding the nuances of different provider types and employing a strategic decision-making process are essential for securing the best possible insurance coverage.

Local Agent versus Online Insurer

Working with a local insurance agent offers personalized service and guidance. Agents can tailor policies to your specific needs, provide expert advice, and assist with claims processing. Conversely, online insurers often offer competitive prices and convenient online tools for managing your policy. However, they may lack the personalized attention of a local agent. The choice depends on your preference for personal interaction versus cost and convenience. A local agent might be preferable for complex insurance needs or those who value a more hands-on approach, while an online insurer might suit those comfortable managing their insurance digitally and prioritizing cost savings. How to compare insurance providers

Key Decision Criteria

Three key criteria to consider when choosing an insurance provider are financial stability, claims handling process, and customer service reputation. Financial stability ensures the insurer can pay out claims when needed; a strong rating from a reputable agency like A.M. Best is a positive indicator. A streamlined and efficient claims handling process minimizes stress during a difficult time. Finally, a positive customer service reputation suggests a provider responsive to customer needs and willing to address concerns promptly and effectively. These factors collectively contribute to a reliable and trustworthy insurance experience.

Balancing Price and Coverage

Weighing price against coverage involves finding the optimal balance between affordability and adequate protection. A cheaper policy with limited coverage might seem attractive initially, but it could leave you financially vulnerable in the event of a significant claim. Conversely, a comprehensive policy with extensive coverage might be more expensive but offers greater peace of mind. Consider your risk tolerance and financial capacity. For instance, someone with significant assets to protect might prioritize comprehensive coverage despite the higher cost, while someone with limited resources might prioritize a more affordable plan, even if it offers less extensive coverage. The key is to find a plan that provides sufficient protection without unduly straining your budget. How to compare insurance providers

Factors to Consider When Comparing Policies

Before making a final decision, carefully compare different policies offering similar coverage. Consider the following factors:

- Deductibles: The amount you pay out-of-pocket before insurance coverage begins.

- Premiums: The regular payments made to maintain insurance coverage.

- Co-pays: The fixed amount you pay for specific services.

- Coinsurance: The percentage of costs you share after meeting your deductible.

- Exclusions: Specific events or conditions not covered by the policy.

- Policy Limits: The maximum amount the insurer will pay for a covered event.

- Renewal Terms: How and when the policy can be renewed.

- Customer Reviews and Ratings: Independent assessments of the insurer’s performance.

Analyzing these aspects ensures a comprehensive understanding of the policy’s terms and conditions, leading to an informed decision.

Illustrating Coverage Differences

Understanding the nuances of insurance coverage is crucial for making informed decisions. Different plans offer varying levels of protection and financial responsibility, impacting your out-of-pocket expenses significantly. The following scenarios illustrate how seemingly small differences in policy details can lead to substantial variations in claims payouts.

High Deductible vs. Low Deductible Insurance Plans

Consider two individuals, both with similar health needs, but with different health insurance plans. Sarah has a high-deductible health plan (HDHP) with a $5,000 deductible and a lower monthly premium of $200. John, on the other hand, has a low-deductible plan with a $500 deductible and a higher monthly premium of $450. If both experience a $10,000 medical emergency, Sarah will pay $5,000 out-of-pocket before her insurance begins to cover expenses. John, however, will only pay $500. While John pays more monthly, his out-of-pocket expenses in this scenario are significantly less. This highlights the trade-off between lower premiums and higher out-of-pocket costs with high-deductible plans. How to compare insurance providers

Liability Coverage Limits in a Car Accident

Imagine a car accident where Maria, insured with $50,000 liability coverage, rear-ends David’s car. The damage to David’s car totals $60,000, and he incurs $10,000 in medical expenses. Maria’s insurance will cover $50,000 of the damages, leaving David responsible for the remaining $20,000. If Maria had a higher liability limit, say $100,000, her insurance would have fully covered David’s expenses. This demonstrates the importance of adequate liability coverage to protect yourself from potentially catastrophic financial consequences in the event of an accident.

Home Repair Claims After a Natural Disaster

Suppose a hurricane causes damage to both Anna’s and Ben’s homes. Anna has a standard homeowners insurance policy with flood coverage. Her home suffers $20,000 in wind damage and $10,000 in flood damage; both are covered by her policy. Ben, however, only has basic homeowners insurance without flood coverage. His home suffers $15,000 in wind damage, which is covered, but the $12,000 in flood damage is not. This illustrates how seemingly minor differences in policy coverage, such as the inclusion or exclusion of flood insurance, can drastically impact the financial burden following a natural disaster. The crucial element is understanding the specific perils covered by the policy. How to compare insurance providers

Choosing the right insurance provider requires careful consideration and a comprehensive understanding of your needs. By systematically comparing prices, coverage options, provider reputation, and policy details, you can confidently select a plan that offers optimal protection and value. Remember, proactive research and a thorough comparison are key to securing the best insurance for your unique circumstances. Don’t hesitate to ask questions and seek clarification to ensure complete understanding before committing to a policy.

FAQ Corner

What is the difference between a deductible and a co-pay?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A co-pay is a fixed amount you pay for a covered service, like a doctor’s visit, regardless of the total cost.

How often should I review my insurance policy?

It’s advisable to review your insurance policy annually, or whenever there’s a significant life change (marriage, new home, etc.), to ensure it still meets your needs.

Can I cancel my insurance policy at any time?

Generally, yes, but you may face penalties or fees depending on your policy and the insurer’s terms and conditions. Check your policy for details. How to compare insurance providers

What happens if I file a fraudulent claim?

Filing a fraudulent claim is a serious offense and can result in policy cancellation, legal repercussions, and damage to your credit score. How to compare insurance providers

How can I dispute a claim denial?

Your insurance policy should Artikel the process for appealing a claim denial. Contact your insurer immediately and follow their Artikeld procedures for dispute resolution.