Insurance claim process navigation can feel daunting, but understanding the steps involved empowers you to navigate this often complex procedure with confidence. This guide provides a clear, step-by-step approach to filing a claim, regardless of whether it’s for your car, home, or health. We will explore the various claim types, required documentation, common issues, and strategies for successful claim resolution. From initiating a claim to appealing a denial, we aim to equip you with the knowledge and tools for a smoother experience.

We’ll cover everything from choosing the best method for submitting your claim—online portal, phone call, or mail—to effectively communicating with insurance adjusters and understanding the factors that influence claim settlement amounts. This guide also provides practical advice on preventing claim issues altogether, emphasizing proactive measures to minimize potential problems.

Understanding the Insurance Claim Process

Filing an insurance claim can seem daunting, but understanding the process can significantly ease the experience. This section Artikels the general steps involved, highlights differences between claim types, and provides examples of necessary documentation. Successfully navigating a claim often depends on clear communication and accurate documentation.

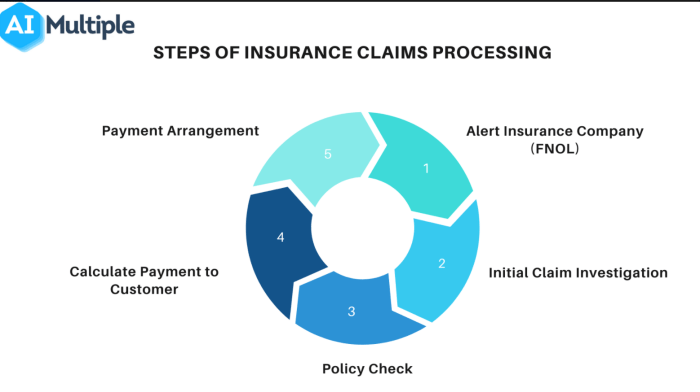

General Steps in Filing an Insurance Claim

The basic process generally involves reporting the incident to your insurer, gathering necessary documentation, completing claim forms, and providing any requested information. Your insurer will then investigate the claim, determine liability, and assess damages. Finally, they will issue a settlement or denial, outlining their decision and rationale. This process varies depending on the type of insurance and the specifics of the incident.

Differences Between Claim Types, Insurance claim process

Insurance claims vary significantly depending on the type of policy. Auto insurance claims typically involve accidents, while home insurance claims might encompass damage from fire, theft, or weather events. Health insurance claims relate to medical expenses, requiring different documentation and processing times. Each type requires a specific approach to ensure a smooth and efficient process.

Common Documentation Needed for Different Claim Types

The required documentation varies considerably depending on the claim type. For auto insurance, this typically includes police reports (if applicable), photos of the damage, and details of all involved parties. Home insurance claims may require similar photographic evidence, along with repair estimates and receipts for any related expenses. Health insurance claims necessitate medical bills, doctor’s notes, and potentially diagnostic test results. Careful documentation is crucial for successful claim processing.

Claim Type Documentation, Processing Time, and Common Issues

| Claim Type | Required Documents | Processing Time | Common Issues |

|---|---|---|---|

| Auto | Police report (if applicable), photos of damage, vehicle information, driver’s licenses, insurance information | 2-4 weeks (can vary significantly) | Disputes over liability, inaccurate assessment of damages, delays in appraisal |

| Home | Photos of damage, repair estimates, receipts for related expenses, police report (if applicable), homeowner’s insurance policy | 4-8 weeks (can vary significantly depending on the extent of damage) | Difficulties in determining the cause of damage, disputes over coverage, delays in finding contractors |

| Health | Medical bills, doctor’s notes, explanation of benefits (EOB), diagnostic test results | 1-4 weeks (depending on the insurer and complexity of the claim) | Pre-authorization issues, disputes over medical necessity, coding errors |

Initiating an Insurance Claim

Starting the insurance claims process can feel daunting, but understanding the available methods and best practices can significantly streamline the experience. Choosing the right method depends on your comfort level with technology, the urgency of your claim, and the complexity of the situation.

Initiating a claim typically involves reporting the incident and providing necessary information to your insurance provider. This ensures a prompt and efficient processing of your claim. Accurate and thorough documentation is crucial throughout this process.

Methods for Initiating an Insurance Claim

Several methods exist for initiating an insurance claim, each with its own set of advantages and disadvantages. Choosing the most suitable method will depend on individual circumstances and preferences.

- Online Portal: Many insurance companies offer user-friendly online portals for submitting claims. This method provides convenience and allows for tracking claim progress online.

- Phone Call: Contacting your insurance provider directly via phone allows for immediate interaction with a representative. This can be particularly helpful for complex claims or when immediate assistance is needed.

- Mail: Submitting a claim via mail is a traditional method, suitable for those who prefer written communication. However, it’s generally the slowest method.

Advantages and Disadvantages of Claim Initiation Methods

A comparison of the advantages and disadvantages of each method helps in making an informed decision.

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Portal | Convenient, accessible 24/7, trackable progress | Requires internet access and technical proficiency, may lack immediate human interaction |

| Phone Call | Immediate assistance, personalized interaction, suitable for complex claims | May involve hold times, less documentation immediately available |

| Simple for those less tech-savvy | Slowest method, lack of immediate feedback, difficult to track progress |

Best Practices for Documenting Initial Claim Submission

Thorough documentation is vital for a smooth claims process. This helps prevent delays and ensures all necessary information is readily available.

- Keep detailed records of all communication with your insurance provider, including dates, times, and names of individuals contacted.

- Maintain copies of all submitted documents, such as police reports, medical bills, or repair estimates.

- Take clear photographs or videos of any damage to property or injuries sustained.

- Note down the claim reference number provided by your insurer.

Step-by-Step Guide for Submitting a Claim Online

Submitting a claim online typically follows a structured process. Following these steps ensures a complete and accurate submission.

- Log in to your online account: Access your insurance company’s website and log in using your credentials.

- Locate the claims section: Navigate to the section dedicated to filing insurance claims. This is often clearly labeled.

- Select the claim type: Choose the appropriate claim type from the options provided (e.g., auto, home, health).

- Provide necessary information: Complete the online form accurately and thoroughly, providing all requested details about the incident and any related documentation.

- Upload supporting documents: Upload any relevant documents, such as photos, police reports, or medical records, as required.

- Review and submit: Carefully review all entered information before submitting your claim. Once submitted, you will typically receive a confirmation number.

Claim Investigation and Assessment

Once you’ve submitted your insurance claim, the process moves into the investigation and assessment phase. This is where the insurance company thoroughly examines the details of your claim to determine its validity and the extent of the covered losses. This involves a careful review of all provided documentation and, often, further investigation to corroborate the information you’ve supplied.

The insurance company’s investigation process typically involves several steps. First, a claims adjuster reviews the initial claim documentation, including the claim form, supporting evidence (photos, receipts, police reports), and your policy details. They then verify the information provided by contacting witnesses, experts, or other relevant parties. For example, in a car accident claim, the adjuster might contact the other driver or review police reports to gather additional information about the accident’s circumstances. Depending on the complexity of the claim, the adjuster might also conduct an on-site inspection of the damaged property. This might involve visiting the scene of an accident or inspecting a damaged home to assess the extent of the damage. Finally, the adjuster compiles all gathered information to prepare a detailed assessment of the claim.

The Investigation Process

The investigation process aims to establish the facts surrounding the incident that led to the claim. This includes determining liability (who was at fault), the extent of the damages, and whether the loss is covered under the terms of your insurance policy. Adjusters use a variety of methods to gather information, ranging from reviewing documents to conducting interviews and site inspections. The thoroughness of the investigation varies depending on the claim’s complexity and the amount of money involved. A small claim might involve a simple review of documentation, while a larger, more complex claim could necessitate extensive investigation, including the hiring of independent experts.

Potential Delays During Investigation

Several factors can lead to delays during the claim investigation. Gathering information from multiple sources can be time-consuming, especially if those sources are uncooperative or difficult to reach. For instance, obtaining police reports or medical records can often be delayed due to bureaucratic processes. Furthermore, if the claim involves complex issues, such as determining liability in a multi-party accident or assessing significant property damage requiring expert opinions, the investigation process might extend significantly. Adverse weather conditions, particularly in cases involving property damage, can also delay on-site inspections. Finally, a high volume of claims processed by the insurance company can also lead to longer processing times.

Reasons for Claim Denials

Claims are denied for several reasons, often stemming from the policy’s terms and conditions or the lack of sufficient evidence to support the claim. Common reasons include: failure to meet the policy’s requirements (e.g., not providing timely notification of the loss), the incident not being covered under the policy (e.g., damage caused by a pre-existing condition), fraudulent claims (e.g., providing false information), or insufficient evidence to support the claim’s validity. For example, a claim for theft might be denied if there’s no police report or other credible evidence to corroborate the claim. Similarly, a claim for damage to a property due to flooding might be denied if the policy specifically excludes flood damage.

Strategies for Communicating with the Insurance Adjuster

Effective communication with your insurance adjuster is crucial for a smooth claim process. Maintain a professional and courteous demeanor throughout all interactions. Respond promptly to all requests for information, providing clear and concise answers. Keep detailed records of all communication, including dates, times, and the content of conversations. If you disagree with the adjuster’s assessment, clearly explain your position, supporting your arguments with evidence. Be patient and persistent; the investigation process can take time, but persistence in following up will help keep the claim moving forward. Consider keeping a detailed log of all communications, including dates, times, and summaries of conversations, as this can be helpful in resolving any discrepancies or misunderstandings.

Claim Settlement and Payment

Once your insurance claim has been investigated and assessed, the process moves to settlement and payment. This stage involves determining the final payout amount and transferring the funds to you. The efficiency and satisfaction of this stage significantly impact your overall experience with the insurance claim process.

The claim settlement process culminates in the release of funds to the policyholder. This involves a careful review of all documentation, a final verification of the claim’s validity and the amount due, and the selection of a suitable payment method. Several factors can influence the final settlement amount and the overall timeline.

Claim Settlement Methods

Several methods exist for receiving your insurance claim settlement. The most common include checks mailed directly to your address, and electronic transfers, such as direct deposit into your bank account. Direct deposit is often preferred for its speed and security, minimizing the risk of lost or stolen checks. Some insurers might also offer payment via other electronic methods, such as mobile payment apps. The specific options available will depend on your insurer and your policy.

Factors Influencing Claim Settlement Amount

The final amount you receive depends on several key factors. Your policy coverage limits are paramount; the settlement cannot exceed the maximum amount specified in your policy for the type of claim. The insurer’s assessment of the damages or losses is also crucial. This assessment considers factors like depreciation (for property claims), the extent of the damage, and any evidence of pre-existing conditions. Furthermore, any deductibles you agreed to pay as part of your policy will be subtracted from the total claim amount. Finally, any policy exclusions will limit the insurer’s liability; for example, flood damage might be excluded from a standard homeowner’s policy.

Common Claim Settlement Disputes

Disputes can arise from various aspects of the claim settlement process. A common point of contention is the insurer’s valuation of damages. Policyholders might disagree with the assessment of the damage, arguing that the insurer’s evaluation is too low. Another source of dispute is the interpretation of policy terms and conditions. Ambiguous wording or disagreements about whether a specific event is covered under the policy can lead to conflict. Finally, delays in payment can also be a significant source of frustration and potential disputes. Clear communication and documentation throughout the process can help mitigate these issues.

Claim Settlement Process Flowchart

The following flowchart illustrates the typical steps involved in the claim settlement process:

- Claim Assessment Completion: The insurance company completes its assessment of the claim.

- Settlement Offer: The insurer makes a settlement offer based on the assessment.

- Policyholder Review: The policyholder reviews the settlement offer and decides whether to accept or negotiate.

- Negotiation (Optional): If necessary, the policyholder and insurer negotiate the settlement amount.

- Settlement Agreement: Once agreed, a settlement agreement is reached and documented.

- Payment Method Selection: The policyholder chooses their preferred payment method (check, direct deposit, etc.).

- Payment Disbursement: The insurer processes the payment according to the chosen method.

- Claim Closure: The claim is officially closed once the payment is received by the policyholder.

Appealing a Denied Claim

Receiving a denied insurance claim can be frustrating, but understanding the appeals process is crucial to potentially securing the benefits you believe you are entitled to. This section Artikels the steps involved in appealing a denied claim, provides examples of effective arguments, and explains how to seek external dispute resolution if necessary.

Steps Involved in Appealing a Denied Claim

The appeals process typically involves several key steps. First, carefully review the denial letter. Understand the reasons for the denial and gather any additional supporting documentation that might refute those reasons. Next, prepare a formal appeal letter. This letter should clearly state your disagreement with the denial, citing specific policy clauses, evidence, and relevant supporting documents. Submit this appeal letter according to the instructions provided in the denial letter, usually through mail or online portal. After submitting your appeal, allow the insurance company the timeframe they specified for review. You will then receive a decision on your appeal. If the appeal is again denied, you may have the option to pursue external dispute resolution.

Examples of Effective Arguments for Appealing a Claim Denial

Effective arguments rely on strong evidence. For example, if your claim was denied due to a pre-existing condition, you might provide medical records demonstrating that the condition did not exist prior to the policy’s effective date. If the denial cites a policy exclusion, you might argue that the situation falls outside the definition of the exclusion or that the exclusion is ambiguous and should be interpreted in your favor. Another example involves a claim denial based on a lack of proof of loss. In this case, you should provide all necessary documentation, such as police reports, medical bills, and receipts. Presenting a clear and concise argument, supported by factual evidence, significantly increases your chances of a successful appeal.

Seeking External Dispute Resolution

If your appeal is unsuccessful, you might consider seeking external dispute resolution. This typically involves contacting your state’s insurance department or a neutral third party, such as an arbitrator or mediator, to review your case. These organizations provide an independent review of the claim and the denial, potentially leading to a fair resolution. The specific process for accessing external dispute resolution varies by state and insurance type, so it’s crucial to research your options thoroughly. For example, some states have mandatory arbitration programs for certain types of insurance disputes.

Necessary Documentation for an Appeal Checklist

Preparing a comprehensive appeal requires meticulous organization. The following checklist highlights essential documents to include:

- A copy of the original claim submission

- The insurance company’s denial letter

- All supporting documentation related to the claim (medical records, police reports, repair estimates, etc.)

- A detailed explanation of why you believe the claim should be approved, referencing specific policy language and providing supporting evidence

- Copies of any relevant communication with the insurance company

- Your policy documents

- Any additional evidence that contradicts the reasons for denial

Preventing Claim Issues

Proactive measures significantly reduce the likelihood of claim denials and streamline the insurance claims process. By understanding your policy, maintaining thorough records, and fostering open communication with your insurer, you can minimize potential problems and ensure a smoother experience should you need to file a claim.

Accurate and comprehensive documentation is the cornerstone of a successful claim. Failing to provide sufficient evidence can lead to delays or even denial. Maintaining good communication with your insurance provider is equally crucial; it fosters a collaborative relationship and allows for prompt clarification of any uncertainties.

Minimizing the Risk of Claim Denials

Careful adherence to your policy’s terms and conditions is paramount. Understanding coverage limits, exclusions, and the claims reporting process helps prevent misunderstandings that could lead to denial. For example, failing to report a claim within the stipulated timeframe, often 24-48 hours for auto accidents, can result in a denied claim. Similarly, not providing all the required documentation, such as police reports in the case of an accident, can cause delays or rejection. Regularly reviewing your policy and making necessary adjustments to ensure your coverage aligns with your current needs further minimizes risk.

The Importance of Accurate and Comprehensive Documentation

Detailed records are crucial. This includes photographs of damaged property, receipts for repairs, medical records in case of injury, and witness statements. The more comprehensive your documentation, the stronger your claim. Consider creating a detailed timeline of events, including dates, times, and individuals involved. For instance, in a home insurance claim for water damage, photographs showing the extent of the damage, repair invoices, and a plumber’s report detailing the cause of the damage are essential supporting documents. These records provide irrefutable evidence supporting your claim, speeding up the process and increasing the likelihood of approval.

Benefits of Maintaining Good Communication with the Insurance Provider

Open and proactive communication builds trust and facilitates a smoother claims process. Promptly reporting incidents, providing updates as they become available, and addressing any questions or concerns raised by your insurer helps to maintain transparency and prevent misunderstandings. For example, regularly checking in with your adjuster to confirm the status of your claim and addressing any requests for additional information promptly demonstrates your commitment to a collaborative resolution. This approach fosters a positive working relationship and can expedite the claim settlement.

Infographic: Preventative Measures for Smooth Claim Processing

Imagine a visual infographic, divided into three sections, each representing one of the key preventative measures discussed above.

Section 1: Know Your Policy: This section depicts an open insurance policy document with a magnifying glass highlighting key sections like coverage limits, exclusions, and the claims reporting procedure. Descriptive text emphasizes the importance of understanding policy terms to avoid misunderstandings and potential claim denials. A small calendar icon highlights the importance of timely claim reporting.

Section 2: Document Everything: This section showcases a camera capturing images of damaged property, a stack of organized documents (receipts, medical records, etc.), and a notepad with a detailed timeline of events. The descriptive text emphasizes the need for thorough documentation – photographs, receipts, medical reports, and witness statements – to support the claim and expedite the process.

Section 3: Communicate Effectively: This section illustrates a phone call between the policyholder and their insurance adjuster, with speech bubbles showing clear and concise communication. The descriptive text stresses the importance of prompt reporting, proactive updates, and open communication to build trust and facilitate a smooth resolution. A friendly handshake icon represents the collaborative relationship between the policyholder and the insurer.

Successfully navigating the insurance claim process requires preparation, clear communication, and a thorough understanding of your policy. By following the steps Artikeld in this guide, you can significantly improve your chances of a fair and timely resolution. Remember, proactive documentation, prompt communication with your insurer, and knowledge of your rights are key to a positive outcome. While the process can be challenging, being informed and prepared empowers you to take control and advocate for your needs.

Query Resolution: Insurance Claim Process

What happens if my claim is denied?

If your claim is denied, review the denial letter carefully. Gather supporting documentation and follow the appeal process Artikeld by your insurance company. You may also consider seeking external dispute resolution if necessary.

How long does the insurance claim process typically take?

Processing times vary significantly depending on the claim type, complexity, and the insurer’s workload. Simple claims may be resolved quickly, while more complex ones can take several weeks or even months.

What if I lose my policy documents?

Contact your insurance company immediately. They should have a record of your policy information and can provide you with replacement documents or access to online policy details.

Can I choose my own repair shop for auto damage?

This depends on your policy. Some policies allow you to choose your preferred repair shop, while others may require you to use a shop approved by the insurance company. Check your policy details.

What type of insurance coverage do I need?

The type of coverage you need depends on your individual circumstances and risk tolerance. Consult with an insurance professional to determine the appropriate level of coverage for your needs.