Health insurance plans are crucial for navigating the complexities of healthcare costs. Understanding the various types of plans, from HMOs and PPOs to high-deductible options, is essential for making informed decisions. This guide explores the key factors influencing premium costs, the intricacies of coverage, and the process of selecting a plan that best suits individual needs and budgets. We’ll also delve into the Affordable Care Act’s impact and the procedures for filing claims.

Choosing the right health insurance plan can feel overwhelming, but with a clear understanding of the different options and factors involved, the process becomes significantly more manageable. This guide aims to provide the necessary information and tools to empower individuals to make confident choices about their healthcare coverage.

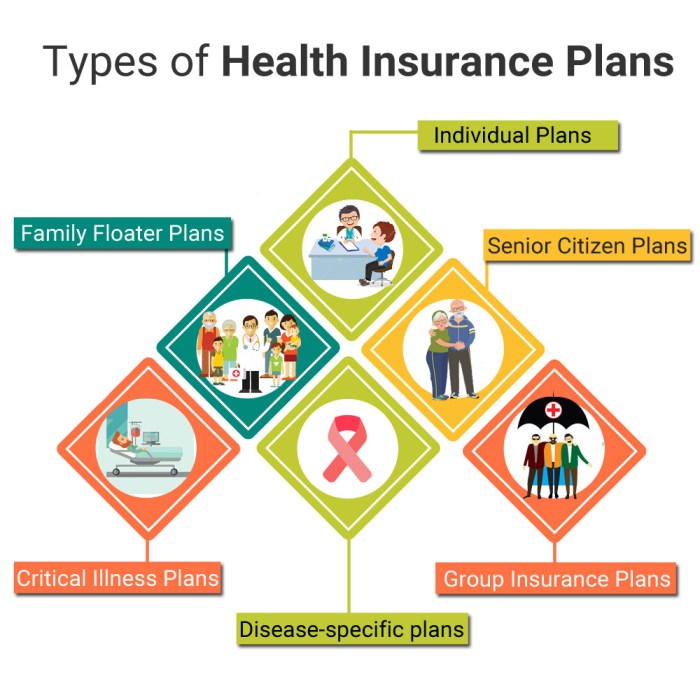

Types of Health Insurance Plans

Choosing the right health insurance plan can feel overwhelming, given the variety of options available. Understanding the key differences between these plans is crucial for making an informed decision that best suits your individual needs and budget. This section will detail the most common types of plans, highlighting their respective advantages and disadvantages.

Health Maintenance Organizations (HMOs)

HMOs typically offer lower premiums in exchange for a more restricted network of doctors and hospitals. You’ll usually need a referral from your primary care physician (PCP) to see specialists. While this can lead to lower out-of-pocket costs within the network, seeking care outside the network is generally not covered. This limited access can be a drawback for some, particularly those who prefer greater choice in their healthcare providers. The cost-effectiveness of an HMO is dependent on staying within the network.

Preferred Provider Organizations (PPOs)

PPOs provide more flexibility than HMOs. You can generally see any doctor or specialist without a referral, though you’ll usually pay less if you stay within the network. Out-of-network coverage is typically available, but at a significantly higher cost. PPOs often have higher premiums than HMOs, reflecting the increased flexibility and broader network access. This makes them a suitable option for those prioritizing convenience and choice.

Exclusive Provider Organizations (EPOs)

EPOs share similarities with HMOs, requiring you to select a PCP and obtain referrals for specialist visits. However, unlike HMOs, EPOs *may* offer some out-of-network coverage, though typically limited and at a much higher cost. The premiums for EPOs usually fall between those of HMOs and PPOs, reflecting a middle ground in terms of cost and flexibility.

Point of Service (POS) Plans

POS plans combine elements of HMOs and PPOs. They usually require you to choose a PCP within the network, but offer the option to see out-of-network providers, albeit at a higher cost. POS plans provide a balance between cost-effectiveness and flexibility, allowing you to choose between in-network and out-of-network care based on your needs. The cost-sharing varies depending on whether care is received in-network or out-of-network.

High-Deductible Health Plans (HDHPs), Health insurance plans

HDHPs are characterized by high deductibles (the amount you pay out-of-pocket before insurance coverage begins) and low premiums. They are often paired with a health savings account (HSA), allowing you to contribute pre-tax dollars to pay for medical expenses. HDHPs are a good choice for healthy individuals who can afford to save for potential medical expenses, as the low premiums offset the high deductible. However, they can be risky for individuals with pre-existing conditions or those who anticipate significant healthcare needs.

Summary of Key Features

| Plan Type | Cost (Premiums) | Coverage | Network Access |

|---|---|---|---|

| HMO | Generally Low | High in-network, Low or None out-of-network | Restricted; Requires referrals |

| PPO | Generally High | High in-network and out-of-network (but higher cost out-of-network) | Broad; No referrals usually required |

| EPO | Moderate | High in-network, Limited out-of-network | Restricted; Requires referrals |

| POS | Moderate | High in-network, Lower out-of-network | Combination; PCP selection required, but out-of-network options available |

| HDHP | Generally Low | High after deductible is met | Varies depending on the plan |

Factors Affecting Health Insurance Premiums

Understanding the cost of your health insurance premiums is crucial for budgeting and choosing the right plan. Several factors contribute to the final price, and knowing these factors can help you make informed decisions. These factors are often interconnected and influence each other to varying degrees.

Several key elements significantly influence the price of health insurance premiums. These factors are considered by insurance companies when assessing risk and setting rates. This assessment helps ensure the financial stability of the insurance pool and allows for the provision of affordable coverage to a wider population.

Age

Age is a significant factor influencing premium costs. Generally, older individuals tend to have higher premiums than younger individuals. This is because the likelihood of needing more extensive medical care increases with age. Insurance companies account for this increased risk by charging higher premiums to older adults. For example, a 65-year-old might pay considerably more than a 25-year-old for the same plan, reflecting the statistically higher healthcare utilization among older populations.

Location

Geographic location plays a considerable role in determining premium costs. Areas with higher healthcare costs, such as those with a high concentration of specialists or expensive medical facilities, will generally have higher premiums. The cost of living in a particular region also influences premium rates. For instance, premiums in a major metropolitan area with high housing costs are typically higher than in a rural area with lower living expenses.

Family Size

The number of people covered under a health insurance plan also affects the premium cost. Adding dependents, such as a spouse or children, increases the overall cost of the plan. This is because the potential for multiple claims increases with the number of covered individuals. A family plan with multiple members will typically have a higher premium than an individual plan.

Tobacco Use

Individuals who use tobacco products, such as cigarettes or chewing tobacco, typically pay higher premiums. This is because smoking and other tobacco use significantly increase the risk of various health problems, leading to higher healthcare utilization and costs. Insurance companies assess this increased risk and reflect it in the premiums charged to smokers. Many insurers offer programs to help smokers quit, potentially leading to lower premiums over time.

Health Status

Pre-existing conditions and current health status can significantly impact premium costs. Individuals with pre-existing conditions, such as diabetes or heart disease, may face higher premiums than those without such conditions. This is because managing these conditions often requires ongoing medical care and medication, resulting in higher healthcare costs. However, the Affordable Care Act (ACA) in many countries has made significant strides in preventing insurers from denying coverage or charging excessively high premiums based solely on pre-existing conditions. However, the extent of this protection can vary depending on specific regulations and plan types.

Impact of Pre-existing Conditions on Premium Costs

Pre-existing conditions can lead to higher premiums. However, regulations like the ACA aim to mitigate this impact. While insurers cannot deny coverage based solely on pre-existing conditions, they might still consider them when setting premiums. The severity and treatment costs associated with the pre-existing condition will influence the premium increase. For example, someone with a history of cancer might experience a higher premium compared to someone with a history of mild allergies.

Strategies to Reduce Health Insurance Premiums

Choosing a health insurance plan involves careful consideration of various factors. Several strategies can help individuals reduce their health insurance premiums.

- Choose a higher deductible plan: Higher deductibles generally result in lower premiums. This means you’ll pay more out-of-pocket before your insurance coverage kicks in.

- Enroll during open enrollment: Missing open enrollment periods can result in higher premiums or penalties.

- Compare plans carefully: Different plans offer varying levels of coverage and cost. Comparing plans from multiple insurers is crucial to find the best value.

- Consider a health savings account (HSA): If eligible, contributing to an HSA can lower your taxable income and help pay for healthcare expenses.

- Maintain a healthy lifestyle: Lifestyle choices, such as not smoking and maintaining a healthy weight, can positively influence your health and potentially lower your premiums in the long run (some insurers offer discounts for healthy lifestyle choices).

Understanding Health Insurance Coverage

Choosing a health insurance plan involves understanding what it covers. This goes beyond simply knowing the premium; it’s crucial to grasp the details of your coverage to ensure you receive the care you need without unexpected financial burdens. This section will clarify the various types of coverage and the financial responsibilities you’ll likely encounter.

Health insurance plans typically cover a range of medical services, aiming to protect you from high medical costs. The extent of this coverage varies significantly depending on the plan’s type and your specific policy. Understanding the nuances of your coverage is key to making informed healthcare decisions.

Types of Covered Services

Most health insurance plans cover a core set of services. These generally include doctor visits (primary care and specialist), hospital stays (inpatient and sometimes outpatient), prescription drugs, and mental health services. However, the specifics of what’s covered, and to what extent, will differ based on your plan. For example, some plans may have preferred networks of doctors and hospitals, meaning you’ll pay less if you use providers within that network. Others may have limitations on the types of prescription drugs covered or require pre-authorization for certain procedures.

Deductibles, Copayments, and Coinsurance

Understanding deductibles, copayments, and coinsurance is essential to managing your out-of-pocket healthcare expenses. These are cost-sharing mechanisms that define your financial responsibility before your insurance kicks in significantly.

A deductible is the amount you must pay out-of-pocket for covered healthcare services before your insurance company starts paying. Once you meet your deductible, your insurance company begins to cover a greater portion of your healthcare costs. For example, if your deductible is $1,000, you’ll pay all costs up to $1,000 before your insurance begins to contribute.

A copayment (or copay) is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit. Copays are usually due at the time of service. For instance, a copay might be $25 for a visit to your primary care physician and $50 for a specialist.

Coinsurance is the percentage of costs you share with your insurance company after you’ve met your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of the cost of covered services, and your insurance company will pay the remaining 80%. This percentage applies until you reach your out-of-pocket maximum.

Real-World Examples

Let’s illustrate with examples:

Scenario 1: Imagine Sarah has a health insurance plan with a $1,000 deductible, a $30 copay for doctor visits, and 20% coinsurance. She visits her doctor (copay of $30), then needs a surgery costing $5,000 after meeting her deductible. Sarah pays $1,000 (deductible) + $30 (copay) + $800 (20% of $4,000 remaining after deductible). Her total out-of-pocket cost is $1,830.

Scenario 2: John has a plan with a $500 deductible, a $40 copay for specialist visits, and 10% coinsurance. He sees a specialist (copay $40), then requires a series of physical therapy sessions totaling $2,000. After meeting his deductible, his coinsurance is 10% of $1,500 ($2,000 – $500), meaning he pays $150. His total out-of-pocket cost is $500 (deductible) + $40 (copay) + $150 (coinsurance) = $690.

Choosing the Right Health Insurance Plan

Selecting the appropriate health insurance plan can feel overwhelming, given the numerous options and varying coverage details. However, a systematic approach can simplify the process and ensure you find a plan that aligns with your individual needs and financial capabilities. This section provides a step-by-step guide to help you navigate this important decision.

A Step-by-Step Guide to Choosing a Health Insurance Plan

Choosing the right health insurance plan involves careful consideration of several factors. Begin by assessing your healthcare needs and budget, then research available plans, compare options, and finally, enroll in the selected plan. This structured approach ensures a well-informed decision.

- Assess Your Healthcare Needs: Consider your current health status, any pre-existing conditions, and your anticipated healthcare utilization in the coming year. Do you frequently visit the doctor? Do you anticipate needing expensive treatments or procedures? A thorough self-assessment will help you prioritize coverage features.

- Determine Your Budget: Establish a realistic budget for your monthly health insurance premiums. Consider your overall financial situation and how much you can comfortably allocate to health insurance without compromising other financial priorities. Remember that lower premiums may mean higher out-of-pocket costs.

- Research Available Plans: Use online marketplaces like Healthcare.gov (in the US) or your country’s equivalent to explore available plans in your area. Pay close attention to the plan details, including the network of doctors and hospitals, coverage levels, and cost-sharing provisions.

- Compare Plans Side-by-Side: Create a comparison table (as shown below) to easily evaluate different plans. This will help you visualize the differences in premiums, deductibles, copays, and out-of-pocket maximums.

- Enroll in Your Chosen Plan: Once you’ve identified the most suitable plan, carefully review the enrollment details and complete the necessary paperwork within the designated enrollment period.

Checklist of Questions to Ask Yourself

Before committing to a health insurance plan, it’s crucial to ask yourself key questions to ensure the plan aligns with your specific requirements. These questions will help you clarify your needs and preferences.

- What is my current health status and anticipated healthcare needs?

- What is my budget for monthly premiums and out-of-pocket expenses?

- Which doctors and hospitals are included in the plan’s network?

- What is the plan’s deductible, copay, and out-of-pocket maximum?

- What types of coverage are included (e.g., hospitalization, prescription drugs, mental health)?

- What are the plan’s limitations and exclusions?

Comparing Health Insurance Plans

A side-by-side comparison is crucial for making an informed decision. The table below illustrates how to compare key aspects of different plans. Note that these are hypothetical examples and actual plan details vary considerably.

| Plan Name | Monthly Premium | Deductible | Copay (Doctor Visit) | Out-of-Pocket Maximum |

|---|---|---|---|---|

| Plan A | $200 | $1,000 | $30 | $5,000 |

| Plan B | $350 | $500 | $50 | $4,000 |

| Plan C | $150 | $2,000 | $20 | $6,000 |

| Plan D | $400 | $0 | $75 | $3,000 |

Navigating the Health Insurance Marketplace: Health Insurance Plans

The Health Insurance Marketplace, often referred to as a health insurance exchange, provides a centralized platform for individuals and families to compare and purchase health insurance plans. Understanding how to navigate this marketplace is crucial to securing affordable and appropriate coverage. The process involves several steps, from creating an account to selecting a plan and enrolling. Resources are available to assist throughout the process, ensuring individuals make informed decisions.

The process of enrolling in a health insurance plan through the marketplace typically begins with creating an account on the designated website for your state or the federal marketplace, Healthcare.gov. You’ll provide personal information, including income details, which are used to determine your eligibility for subsidies and tax credits. Next, you’ll use a screening tool to determine your eligibility for Medicaid or the Children’s Health Insurance Program (CHIP). If not eligible, you’ll then browse the available plans, comparing factors such as premiums, deductibles, co-pays, and network coverage. Finally, you’ll select a plan and complete the enrollment process. It’s important to note that the open enrollment period is typically limited, so timely action is necessary.

Marketplace Assistance Options

Several resources are available to help individuals navigate the complexities of the health insurance marketplace. These include in-person assistance from certified application counselors, online tools and tutorials provided by the marketplace itself, and phone support offering guidance and answering questions. Many community organizations and non-profits also provide assistance, often targeting specific demographics or needs, such as those with limited English proficiency or those with disabilities. These resources provide valuable support to ensure everyone can understand their options and make the best choice for their individual circumstances.

Subsidies and Tax Credits

Subsidies and tax credits play a significant role in making health insurance more affordable for many individuals and families. These government programs reduce the cost of health insurance premiums based on income. The amount of the subsidy or tax credit is determined by household income and the cost of plans in your area. These subsidies can significantly lower monthly premiums, making coverage accessible to those who might otherwise struggle to afford it. For example, a family earning $50,000 annually might receive a substantial subsidy, reducing their monthly premium by hundreds of dollars. This ensures a wider range of individuals can access essential healthcare services. Eligibility is based on modified adjusted gross income (MAGI), as reported on your tax return. The availability and amount of subsidies and tax credits can change annually, so it’s important to check the latest guidelines during the open enrollment period.

Health Insurance and Pre-existing Conditions

Pre-existing conditions, health issues that existed before obtaining health insurance, have historically presented significant challenges for individuals seeking coverage. The Affordable Care Act (ACA) significantly altered the landscape, impacting how insurance companies can handle these conditions and providing greater access to healthcare for millions.

The Affordable Care Act’s Impact on Individuals with Pre-existing Conditions

The ACA’s most impactful provision regarding pre-existing conditions is the prohibition against denying coverage or charging higher premiums based solely on a pre-existing condition. Before the ACA, individuals with pre-existing conditions often faced unaffordable premiums or were denied coverage altogether, leaving them vulnerable to significant financial burdens should they require medical care. The ACA effectively eliminated this discriminatory practice, ensuring that individuals with pre-existing conditions can access health insurance at the same rates as those without. This has been a monumental shift, offering millions of Americans the security of health coverage regardless of their health history.

Insurance Company Discrimination Based on Pre-existing Conditions

Insurance companies are now prohibited from denying coverage or charging higher premiums based solely on pre-existing conditions. However, this does not mean that pre-existing conditions are completely disregarded. Insurers can still consider an individual’s health status when determining premiums, but only in conjunction with other factors such as age, location, and the chosen plan. For example, an individual with a pre-existing condition might pay slightly more than a healthy individual of the same age and location choosing a similar plan, but this difference cannot be solely attributed to the pre-existing condition. The ACA aims to create a more equitable system where health status is one factor among many, rather than the defining factor determining access to care.

Examples of Pre-existing Condition Handling Under Different Health Insurance Plans

The handling of pre-existing conditions varies somewhat depending on the type of health insurance plan. Under ACA-compliant plans, all pre-existing conditions are covered, but the cost-sharing (such as deductibles and co-pays) may vary. For instance, an individual with diabetes might face higher out-of-pocket costs in a high-deductible plan compared to a plan with lower deductibles, but they will still receive coverage for their diabetes treatment. In contrast, before the ACA, this individual may have been denied coverage altogether or faced exorbitant premiums that made coverage unattainable.

Another example: a person with a history of heart disease would receive coverage for related treatments under an ACA-compliant plan. The specific cost of these treatments would depend on their chosen plan’s structure, but they would not be denied coverage based solely on their pre-existing condition. This stands in stark contrast to the pre-ACA era, where such individuals often faced significant barriers to obtaining affordable and comprehensive healthcare. The ACA fundamentally changed the relationship between pre-existing conditions and health insurance access, providing crucial protection for vulnerable populations.

Common Health Insurance Claims and Procedures

Understanding the process of filing health insurance claims is crucial for ensuring timely reimbursement for medical expenses. This section Artikels common claim scenarios, the claim filing process, and strategies to minimize claim denials.

Many everyday healthcare events trigger health insurance claims. These range from routine doctor visits and prescription refills to more significant events like hospital stays, surgeries, and emergency room visits. Even diagnostic tests, such as X-rays or blood work, often generate claims. The complexity of the claim depends heavily on the type of service received and the specifics of your insurance policy.

Common Claim Scenarios

Several scenarios frequently lead to health insurance claims. These include, but are not limited to, doctor visits for routine check-ups and treatment of illnesses, specialist consultations for ongoing conditions, hospitalizations due to illness or injury, emergency room visits for urgent medical needs, prescription drug purchases, and diagnostic testing such as blood tests, X-rays, or MRIs. The specifics of coverage and reimbursement will vary depending on your individual health insurance plan.

The Health Insurance Claim Filing Process

The claim filing process typically involves several steps. While some providers submit claims electronically, others require the patient to file the claim. Accurate and complete documentation is vital for efficient processing.

Generally, the process starts with receiving medical services. The provider then submits a claim to your insurance company, containing details such as the date of service, procedures performed, diagnoses, and charges. Your insurance company processes the claim, applying your policy’s terms and conditions to determine the amount they will cover. You may receive an Explanation of Benefits (EOB) detailing the claim’s status, payments made, and your responsibility for any remaining balance (copay, deductible, or coinsurance).

Required documentation often includes the claim form itself (often pre-filled by the provider), proof of insurance, and sometimes supporting medical records. Timelines vary depending on the insurance company and the complexity of the claim, but you should typically expect a response within a few weeks.

Best Practices for Avoiding Claim Denials

Proactive measures can significantly reduce the likelihood of claim denials. Understanding your policy’s coverage and limitations is the first step. This includes understanding your deductible, copay, coinsurance, and any pre-authorization requirements.

Always verify your insurance coverage before receiving medical services. Confirm that the provider accepts your insurance and understands the pre-authorization procedures, if any. Ensure you accurately complete any required forms and provide all necessary documentation. Keep copies of all submitted documents for your records. If a claim is denied, promptly contact your insurance company to understand the reason for denial and explore options for appeal. Maintaining open communication with your healthcare providers and insurance company is key to a smooth claims process.

Illustrative Example: A Family’s Health Insurance Decision

The Miller family—John, Mary, and their two children, 8-year-old Lily and 15-year-old Tom—found themselves needing to choose a new health insurance plan. Their previous plan was ending, and navigating the options felt overwhelming. They had a combined household income of $120,000 annually and wanted a plan that offered good coverage without breaking the bank.

The Millers began their search by reviewing their state’s health insurance marketplace. They considered several factors crucial to their decision. They prioritized comprehensive coverage for both routine check-ups and potential emergencies, especially considering Tom’s recent diagnosis of mild asthma requiring regular medication. Affordability was paramount, and they aimed to keep their monthly premiums under $1,000. They also looked at the plan’s deductible, out-of-pocket maximum, and co-pays to understand the potential cost-sharing they might face.

Factors Influencing the Millers’ Decision

The Millers’ decision-making process involved careful consideration of several key aspects. First, they examined the network of doctors and hospitals included in each plan. They wanted a plan that included their family doctor and the hospital where they typically receive care. Second, they compared the premiums, deductibles, co-pays, and out-of-pocket maximums of different plans. They created a spreadsheet to compare the costs of various plans under different scenarios (e.g., routine checkups, emergency room visits, prescription medications). Third, they assessed the plan’s coverage for preventive care, as they valued regular check-ups and screenings. Finally, they carefully reviewed the details of each plan’s coverage for pre-existing conditions, ensuring that Tom’s asthma would be adequately covered.

The Millers’ Final Decision

After careful consideration, the Millers chose a “Silver” level plan offered through their state’s marketplace. This plan had a slightly higher monthly premium than some “Bronze” plans but offered significantly lower out-of-pocket maximums and lower co-pays. The lower out-of-pocket maximum provided crucial financial protection in case of unexpected medical expenses, particularly given Tom’s asthma. While the monthly premium was higher than the lowest-cost options, the Millers felt the increased protection against high medical bills was worth the extra cost, aligning with their risk tolerance and financial stability. The plan also included their family doctor and preferred hospital within its network, adding to its appeal. The Millers understood that managing their healthcare costs would require careful consideration of their healthcare utilization and choices, but they felt confident they had chosen a plan that best balanced cost and comprehensive coverage for their family’s needs.

Ultimately, securing appropriate health insurance is a personal journey requiring careful consideration of individual circumstances and priorities. By understanding the nuances of plan types, premium factors, coverage details, and the claims process, individuals can confidently navigate the healthcare system and protect their financial well-being. Remember to utilize the resources available, ask questions, and compare plans diligently to find the best fit for your specific needs.

FAQ Compilation

What is a deductible?

A deductible is the amount you must pay out-of-pocket for healthcare services before your insurance coverage kicks in.

What is the difference between a copay and coinsurance?

A copay is a fixed amount you pay for a covered healthcare service, while coinsurance is a percentage of the cost you pay after meeting your deductible.

Can I change my health insurance plan during the year?

Generally, you can only change plans during the annual open enrollment period, unless you experience a qualifying life event (e.g., marriage, job loss).

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account used to pay for qualified medical expenses. It’s typically paired with a high-deductible health plan.

Where can I find help understanding my Explanation of Benefits (EOB)?

Contact your insurance provider directly; they can provide clarification on your EOB and explain any charges.