Home insurance policies are crucial for protecting your most valuable asset – your home. Understanding the different types of coverage, factors influencing premiums, and the claims process is essential for making informed decisions. This guide explores homeowner’s, renter’s, and condo insurance, detailing their coverage options, add-ons, and the steps involved in filing a claim. We’ll also examine how to choose the right policy to fit your needs and budget, and highlight common exclusions to be aware of.

From dwelling coverage and personal liability protection to understanding the nuances of add-ons like earthquake or flood insurance, this comprehensive overview aims to demystify the world of home insurance, empowering you to make informed choices that safeguard your financial future.

Types of Home Insurance Policies

Choosing the right home insurance policy is crucial for protecting your most valuable asset. Understanding the differences between the various types of policies available is key to making an informed decision. This section will Artikel the key distinctions between homeowner’s, renter’s, and condo insurance, highlighting their respective coverage areas and ideal applications.

Homeowner’s Insurance

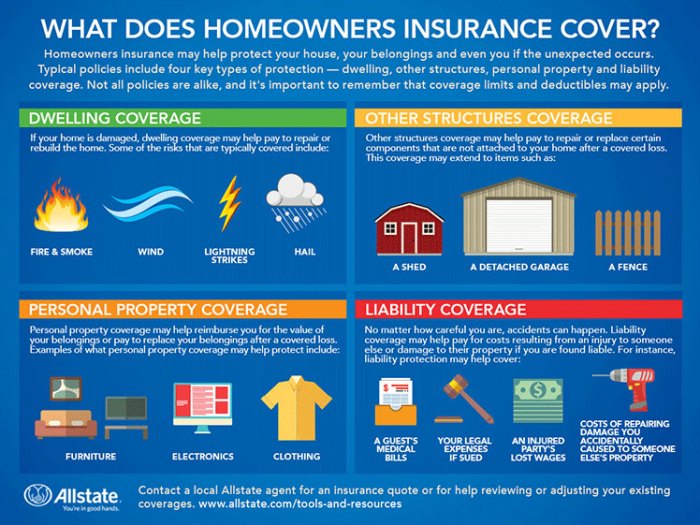

Homeowner’s insurance protects the structure of your home and your personal belongings from various perils, such as fire, theft, and weather damage. This policy typically includes dwelling coverage (for the house itself), personal property coverage (for your belongings), liability coverage (protecting you from lawsuits if someone is injured on your property), and additional living expenses (covering temporary housing if your home becomes uninhabitable due to a covered event). A homeowner’s policy is appropriate for individuals who own their home outright or have a mortgage. For example, if a fire damages your home, your homeowner’s insurance would cover the cost of repairs or rebuilding, as well as replacing your damaged furniture and personal belongings.

Renter’s Insurance, Home insurance policies

Renter’s insurance, unlike homeowner’s insurance, does not cover the structure of the building itself. Instead, it focuses on protecting your personal belongings within the rental property and providing liability coverage. This means that if your possessions are damaged or stolen, or if someone is injured in your apartment and sues you, your renter’s insurance will help cover the costs. Additional living expenses are also usually included, covering temporary housing if your apartment becomes uninhabitable due to a covered incident. Renter’s insurance is a cost-effective way to protect your personal assets and is essential for anyone renting an apartment, house, or condo. For instance, if a pipe bursts and damages your belongings, renter’s insurance would cover the replacement costs.

Condo Insurance

Condo insurance sits somewhere between homeowner’s and renter’s insurance. It typically covers your personal belongings and liability, similar to renter’s insurance. However, it also covers improvements and alterations you’ve made to your condo unit, which are not typically covered by renter’s insurance. It’s important to note that condo insurance does *not* cover the building’s structure itself; that’s typically covered by the condo association’s master policy. Condo insurance is designed specifically for individuals who own a condo unit. For example, if a fire damages your condo unit’s interior walls or flooring, your condo insurance would cover the repair or replacement costs, assuming the damage is not covered by the master policy.

Comparison of Home Insurance Policies

The following table summarizes the key differences between homeowner’s, renter’s, and condo insurance:

| Policy Type | Dwelling Coverage | Personal Property Coverage | Liability Coverage |

|---|---|---|---|

| Homeowner’s Insurance | Covers the structure of your home | Covers your personal belongings | Covers legal liability for injuries or damages on your property |

| Renter’s Insurance | Does not cover the building structure | Covers your personal belongings | Covers legal liability for injuries or damages in your rental unit |

| Condo Insurance | Covers improvements and alterations to your condo unit, but not the building structure | Covers your personal belongings | Covers legal liability for injuries or damages in your condo unit |

Coverage Options and Add-ons

Choosing a home insurance policy involves understanding the core coverage and considering additional protections tailored to your specific needs and risks. While a standard policy provides foundational coverage for dwelling, personal property, and liability, many supplemental options exist to enhance your protection against unforeseen circumstances. These add-ons offer peace of mind but come with increased premiums, so careful consideration is crucial.

Standard home insurance policies typically cover damage to your home’s structure and your belongings due to covered perils like fire, wind, or theft. However, many events are not included in basic policies. Understanding these limitations and the availability of supplemental coverage is key to ensuring comprehensive protection.

Earthquake Insurance

Earthquake insurance is a separate policy, not typically included in standard homeowners insurance. It covers damage to your home and belongings caused by earthquakes, including tremors and ground shifts. The cost of earthquake insurance varies significantly based on your location’s seismic risk and the value of your property. For instance, a homeowner in California, a high-risk zone, would pay considerably more than someone in a low-risk state like Iowa. The benefit is clear: protection against catastrophic losses that could otherwise leave you financially devastated. The drawback is the additional cost, which can be substantial in high-risk areas.

Flood Insurance

Flood insurance, similarly to earthquake insurance, is usually purchased separately. It protects your home and belongings from flood damage, a peril frequently excluded from standard policies. The cost of flood insurance is determined by your property’s location within a flood zone, the value of your property, and the level of coverage you choose. For example, a home situated in a high-risk flood plain would have significantly higher premiums compared to a home located in a low-risk area. The benefit is obvious protection against a common and costly disaster. The drawback is that it is an additional expense, and it doesn’t cover all flood-related damages, such as mold remediation, which might require separate coverage.

Personal Liability Coverage

Personal liability coverage protects you from financial losses resulting from accidents or injuries that occur on your property or for which you are legally responsible. This coverage extends to medical expenses, legal fees, and judgments awarded against you. While a basic policy usually includes some liability coverage, increasing this limit is a valuable add-on. For example, increasing your liability coverage from $100,000 to $500,000 provides significantly greater protection against substantial claims. The benefit is financial protection against potentially devastating lawsuits. The drawback is the increase in premium, though the cost is often relatively low considering the potential for substantial financial protection.

Additional Coverage Add-ons: Examples and Costs

Several other add-ons can significantly enhance your home insurance policy. These add-ons and their associated costs are highly variable depending on your location, insurer, and the specifics of your home and property.

Examples include:

- Scheduled Personal Property Coverage: Provides higher coverage limits for specific valuable items like jewelry or art. Costs vary greatly depending on the value of the items being insured.

- Identity Theft Protection: Covers expenses related to identity theft recovery. Costs are usually a relatively small addition to your overall premium.

- Water Backup and Sewer Backup Coverage: Protects against damage from sewer backups and water that backs up from drains or other sources. Costs depend on factors such as the age and condition of your plumbing system.

- Replacement Cost Coverage: Covers the full cost of replacing damaged items, regardless of their actual cash value. This differs from actual cash value coverage, which considers depreciation. The cost increase is usually dependent on the value of your home and belongings.

Factors Affecting Premiums

Understanding the factors that influence your home insurance premium is crucial for securing affordable coverage. Several key elements contribute to the final cost, and knowing these can help you make informed decisions about your policy and potentially reduce your expenses. Insurance companies use a complex calculation, weighing various aspects of your property and your personal risk profile.

Several key factors influence the calculation of your home insurance premium. These factors are carefully considered by insurance companies to assess the level of risk associated with insuring your property. The more risk a company perceives, the higher the premium they will charge to offset potential losses.

Location

Your home’s location significantly impacts your premium. Areas prone to natural disasters, such as hurricanes, earthquakes, wildfires, or floods, carry higher premiums due to the increased likelihood of claims. Furthermore, the crime rate in your neighborhood also plays a role; higher crime rates translate to a greater risk of theft or vandalism, leading to higher premiums. For example, a home located in a coastal area frequently hit by hurricanes will have a substantially higher premium compared to a similar home in an inland area with a low crime rate. The specific location data used by insurers often includes factors such as proximity to fire hydrants and the type of construction materials prevalent in the area.

Age and Condition of the Home

Older homes generally cost more to insure than newer ones. This is because older homes may have outdated plumbing or electrical systems, increasing the risk of damage. The materials used in construction also play a role; homes built with less fire-resistant materials will likely attract higher premiums. Regular maintenance and upgrades, however, can mitigate this risk and potentially lower your premium. For instance, replacing an old roof with a more durable, fire-resistant one could result in a lower premium. A comprehensive home inspection can highlight potential issues and suggest improvements to reduce your insurance costs.

Credit Score

Many insurance companies use credit scores as an indicator of risk. A good credit score often suggests responsible financial behavior, which is correlated with a lower likelihood of making claims. Conversely, a poor credit score may signal a higher risk profile, leading to increased premiums. This is because insurers often view a poor credit score as a potential indicator of higher risk-taking behaviors, increasing the chances of claims. The exact weight given to credit scores varies among insurance companies, but it remains a significant factor for many.

Claims History

Your claims history is a major factor influencing premiums. Filing multiple claims in a short period suggests a higher risk profile, resulting in increased premiums. Conversely, a clean claims history, indicating responsible homeownership and fewer incidents, usually leads to lower premiums. Insurance companies carefully track your claims history, and even a single significant claim can impact your future premiums for several years. It’s important to only file claims for legitimate reasons and to take preventative measures to reduce the likelihood of future incidents.

Premium Calculation Methods

Different insurance companies employ varying methods for calculating premiums. While the core factors remain consistent, the weighting given to each factor can differ significantly. Some companies may place more emphasis on location, while others might prioritize credit score or claims history. These variations in calculation methods lead to differences in premium quotes from different insurers, highlighting the importance of comparing multiple quotes before selecting a policy. Some insurers might also utilize sophisticated actuarial models that incorporate additional data points, leading to even more nuanced premium calculations.

Hypothetical Scenario

Consider two homeowners, Sarah and John, with similar homes in different locations. Sarah lives in a low-risk area with a good credit score and no claims history. John lives in a high-risk area prone to wildfires, has a fair credit score, and filed a claim for water damage last year. Sarah will likely receive a significantly lower premium compared to John due to the combined effect of location, credit score, and claims history. Even if their homes are identical in size and age, the differences in these factors will result in substantial variation in their insurance costs. This illustrates how seemingly small differences can significantly impact the final premium.

Filing a Claim

Filing a home insurance claim can seem daunting, but understanding the process can make it significantly smoother. This section provides a step-by-step guide to navigate the claim process, from initial reporting to receiving your payout. Remember to always refer to your specific policy documents for detailed instructions and requirements.

Step-by-Step Claim Filing Guide

The claim filing process generally involves several key steps. Prompt action after an incident is crucial to ensure a timely resolution.

- Report the Incident: Immediately contact your insurance provider to report the damage. Note the date, time, and circumstances of the incident. Many companies offer 24/7 claims reporting lines.

- File a Claim Form: Your insurer will likely provide a claim form to complete. This form requires detailed information about the incident, including the extent of the damage.

- Cooperate with the Investigation: Your insurer may send an adjuster to assess the damage. Cooperate fully with their investigation, providing access to your property and answering their questions honestly and thoroughly.

- Provide Supporting Documentation: Gather all necessary documentation to support your claim (detailed below). The more comprehensive your documentation, the smoother the process will be.

- Review the Claim Assessment: Once the adjuster has completed their assessment, they will provide you with a report outlining the estimated cost of repairs or replacement. Review this report carefully and contact your insurer if you have any questions or disagreements.

- Receive Your Payout: After the assessment and any necessary negotiations, your insurer will process your claim and issue a payout. The method of payment will depend on your policy and the insurer’s procedures.

Required Documentation

Supporting your claim with comprehensive documentation is essential for a swift and successful resolution. Missing documentation can delay the process significantly.

- Proof of Ownership: Provide documentation showing you own the property, such as a deed or mortgage statement.

- Police Report (if applicable): If the damage resulted from a crime (e.g., theft, vandalism), a police report is crucial.

- Photos and Videos: Detailed photographic and video evidence of the damage is essential. Capture the damage from multiple angles, including close-ups and wider shots showing the context.

- Repair Estimates: Obtain written estimates from reputable contractors for the cost of repairs or replacement.

- Inventory of Damaged Items: Create a detailed inventory of damaged or stolen items, including descriptions, purchase dates, and receipts or proof of value.

Damage Assessment and Payout Determination

The assessment of damages is conducted by a claims adjuster, who will inspect the property and review the documentation provided. The adjuster will then determine the extent of the damage and the appropriate payout amount based on your policy coverage and the actual cash value (ACV) or replacement cost value (RCV) of the damaged items. The ACV considers depreciation, while the RCV covers the cost of replacing the item with a new one.

For example, if a ten-year-old appliance is damaged, the ACV would be lower than the RCV because it accounts for the appliance’s age and wear and tear.

Common Claim Scenarios and Procedures

Different scenarios require specific procedures. Understanding these common scenarios can help you prepare and expedite the claim process.

| Scenario | Procedure |

|---|---|

| Fire Damage | Immediately contact the fire department and your insurer. Secure the property to prevent further damage. Cooperate with the investigation and provide detailed documentation of losses. |

| Water Damage | Mitigate further damage by removing excess water and preventing mold growth. Document the damage thoroughly with photos and videos. Obtain estimates for repairs and replacement. |

| Theft or Vandalism | File a police report immediately. Document the stolen or damaged items with photos and descriptions. Provide any available security footage. |

| Wind or Storm Damage | Take photos and videos of the damage. Secure the property to prevent further damage. Contact your insurer and any necessary contractors for repairs. |

Choosing the Right Policy

Selecting the right home insurance policy is crucial for protecting your most valuable asset. The process can feel overwhelming, given the variety of options and complexities involved. However, by carefully considering your needs and comparing different providers, you can find a policy that offers adequate coverage at a price you can afford. This involves understanding your coverage requirements, comparing quotes effectively, and asking the right questions to insurance providers.

Comparing Home Insurance Quotes

Effectively comparing quotes requires a systematic approach. First, gather quotes from multiple insurers. Don’t just focus on the premium; ensure you’re comparing apples to apples. This means comparing policies with similar coverage levels. Pay close attention to the deductibles offered and the specific perils covered. For example, some policies might offer better flood coverage than others, a crucial factor in flood-prone areas. Organize the quotes in a spreadsheet or table to easily compare premiums, deductibles, and coverage details side-by-side. Note any differences in policy terms and conditions, such as cancellation policies or claim procedures. Consider using a comparison website, but remember to verify the information independently with the insurers themselves.

Key Considerations When Selecting a Home Insurance Policy

A checklist of crucial factors ensures a comprehensive evaluation of each policy. These include the replacement cost of your home, which should be regularly updated to reflect current construction costs. You should also factor in the value of your personal belongings, considering inflation and any recent high-value purchases. The level of liability coverage you need depends on your personal assets and risk tolerance; higher coverage protects you against substantial lawsuits. Deductibles significantly impact your premiums; a higher deductible lowers your premium but increases your out-of-pocket expenses in case of a claim. Finally, consider the insurer’s financial stability and customer service ratings; these indicators reflect the insurer’s ability to pay claims and provide timely assistance.

Questions to Ask Insurance Providers

Before committing to a policy, it’s essential to clarify any uncertainties. Inquire about the specific coverage details, including what is and isn’t covered under different scenarios. Ask about the claims process – how long it takes, what documentation is required, and how payments are handled. Understanding the insurer’s cancellation policy and any potential penalties for early termination is vital. Inquire about discounts offered, such as those for security systems or bundled policies. Finally, ask about the insurer’s customer service reputation and the accessibility of their customer support channels.

Creating a Personalized Home Insurance Checklist

Developing a tailored checklist ensures you don’t overlook critical elements specific to your situation. Start by assessing the replacement cost of your home using current construction costs and factoring in any renovations or additions. Next, inventory your personal belongings, noting high-value items and their estimated replacement cost. Determine your desired liability coverage based on your assets and risk profile. Choose a deductible that balances affordability with your risk tolerance. Research the insurer’s financial strength ratings and read customer reviews to gauge their reliability and responsiveness. Finally, compare quotes from multiple insurers, focusing on coverage details as much as premiums. This personalized approach helps you choose a policy that aligns with your individual needs and budget.

Understanding Policy Exclusions

Home insurance policies, while designed to protect your property and belongings, don’t cover every conceivable event. Understanding the exclusions within your policy is crucial to avoid disappointment and financial hardship when you need to file a claim. This section will detail common exclusions and how to potentially secure additional coverage.

Common Exclusions in Home Insurance Policies

Many standard home insurance policies exclude coverage for specific types of damage or loss. These exclusions are often based on the high likelihood of widespread damage and the associated high costs for insurance providers. Familiarizing yourself with these common exclusions is a vital step in protecting your financial interests.

Flood Damage

Flood damage is almost universally excluded from standard home insurance policies. This exclusion applies to damage caused by overflowing rivers, lakes, or oceans, as well as heavy rainfall leading to significant water accumulation. Claims for water damage resulting from a burst pipe, on the other hand, are typically covered, as this is considered a covered peril. For example, a homeowner whose basement floods due to a nearby river overflowing would likely have their claim denied, whereas a homeowner whose basement floods due to a faulty washing machine would likely be covered. To obtain coverage for flood damage, separate flood insurance is necessary, often purchased through the National Flood Insurance Program (NFIP) in the United States, or equivalent programs in other countries.

Earthquake Damage

Similar to flood damage, earthquake damage is typically excluded from standard home insurance policies. The widespread and often catastrophic nature of earthquakes makes them a high-risk event for insurers. This exclusion applies to damage caused directly by seismic activity, including ground shaking, tremors, and resulting structural damage. For example, a house sustaining cracks in its foundation due to an earthquake would not be covered under a standard home insurance policy. To obtain coverage for earthquake damage, an earthquake endorsement or separate policy must be purchased.

Acts of War

Acts of war are explicitly excluded from virtually all home insurance policies. This exclusion encompasses damage or loss resulting from declared or undeclared war, acts of terrorism, and other forms of hostile military action. The unpredictable nature and potentially massive scale of such events make them uninsurable under standard policies. For instance, a house destroyed by a missile strike during a war would not be covered. There is generally no alternative coverage for losses due to acts of war.

Other Common Exclusions

Beyond the major exclusions already discussed, many policies exclude coverage for damage caused by neglect, intentional acts, or certain types of wear and tear. Specific exclusions can vary depending on the insurer and the policy details. It’s essential to carefully review your policy’s specific exclusions to understand what is and is not covered. Always clarify any ambiguities with your insurance provider.

Illustrative Example: Home Damaged by Fire

The following scenario illustrates a typical home fire incident and the subsequent insurance claim process. Understanding this example can help homeowners better prepare for such unforeseen events and navigate the complexities of their insurance policies.

The Miller family’s two-story home suffered significant damage from a kitchen fire that started late one evening. The fire, originating from a faulty electrical appliance, quickly spread throughout the kitchen, engulfing the adjacent living room and causing extensive smoke damage to the upper floor. The fire department managed to extinguish the blaze, but not before significant structural damage occurred to the kitchen and living room, including a collapsed ceiling and significant charring of wooden beams. Many of the Miller’s possessions were destroyed or severely damaged by fire, smoke, and water used in extinguishing the fire, including furniture, appliances, clothing, and family heirlooms. The family was fortunate to escape unharmed, but were temporarily displaced due to the uninhabitable condition of their home.

Homeowner Actions After the Fire

Immediately after the fire, the Millers contacted their insurance company to report the incident and begin the claims process. They also contacted the fire department for a report detailing the cause and extent of the damage. They then secured temporary housing and began documenting their losses by taking photographs and videos of the damaged property and compiling a list of destroyed or damaged possessions, along with purchase receipts or appraisals where possible. This thorough documentation proved crucial in supporting their claim. They also kept detailed records of all communication with their insurance company and any expenses incurred due to the fire, such as temporary accommodation and storage fees.

Insurance Company Assessment and Payout

The insurance company dispatched an adjuster to assess the damage to the Miller’s home. The adjuster meticulously documented the extent of the structural damage, the cost of repairs, and the value of the destroyed or damaged possessions. The adjuster’s report included detailed photographs and an itemized list of losses, along with estimates for repair costs and replacement values. The Millers’ homeowner’s insurance policy covered fire damage, and the insurance company agreed to cover the cost of repairs to the house, including structural repairs, replacement of appliances, and remediation of smoke and water damage. The company also compensated the Millers for the value of their lost possessions, based on the provided documentation and the policy’s limits. There were some minor discrepancies regarding the valuation of certain items, which led to a brief negotiation period, but the matter was resolved amicably through the insurance company’s dispute resolution process. The final payout covered the majority of the Millers’ losses, enabling them to rebuild their home and replace their belongings.

Challenges in the Claims Process

While the claims process generally went smoothly for the Millers, there were some minor challenges. Accurately documenting all damaged possessions proved time-consuming, and obtaining receipts for older items was difficult. The negotiation regarding the valuation of certain items, though resolved quickly, highlighted the importance of maintaining detailed records and appraisals for valuable possessions. The delay in receiving the final payout, while within the company’s standard processing time, caused some temporary financial strain. These challenges underscore the importance of having a comprehensive insurance policy and understanding the claims process before an event occurs.

Securing the right home insurance policy is a significant step in protecting your financial well-being. By understanding the various types of coverage, factors affecting premiums, and the claims process, you can make informed decisions that align with your specific needs and budget. Remember to carefully review policy exclusions and compare quotes from multiple providers to ensure you obtain the most comprehensive and cost-effective protection for your home and belongings. Proactive planning and a thorough understanding of your policy are key to peace of mind.

FAQ Explained: Home Insurance Policies

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV considers depreciation when paying a claim, meaning you receive the item’s value minus its depreciation. Replacement cost coverage pays the cost of replacing the item with a new one, regardless of depreciation.

How long does it typically take to settle a home insurance claim?

The timeframe varies depending on the complexity of the claim and the insurance company. Simple claims might be settled within a few weeks, while more complex ones can take several months.

Can I increase my coverage limits after purchasing a policy?

Generally, yes. You can typically request an increase in coverage limits by contacting your insurance provider. This may result in a premium adjustment. Home insurance policies

What happens if I don’t have homeowners insurance and a disaster damages my home?

You would be personally responsible for all repair or replacement costs. This could lead to significant financial hardship. Home insurance policies

Does home insurance cover damage caused by pets?

Coverage for pet-related damage varies depending on the policy and the specifics of the incident. Some policies may cover damage caused by accidents, while others may exclude intentional damage.