Understanding the difference between personal and corporate income taxes is essential for anyone navigating the world of taxation, whether you’re a business owner, a self-employed individual, or just curious about how taxes work. While both tax systems aim to generate revenue for government services, they operate differently and affect taxpayers in various ways. This article will break down the key differences between personal and corporate income taxes, making it easier for you to grasp the essentials.

1. What Are Income Taxes?

a. Definition of Income Taxes

Income taxes are financial charges imposed by the government on the income earned by individuals and businesses. The government uses these taxes to fund public services, infrastructure, and various programs that benefit society.

b. Types of Income Taxes

There are primarily two types of income taxes:

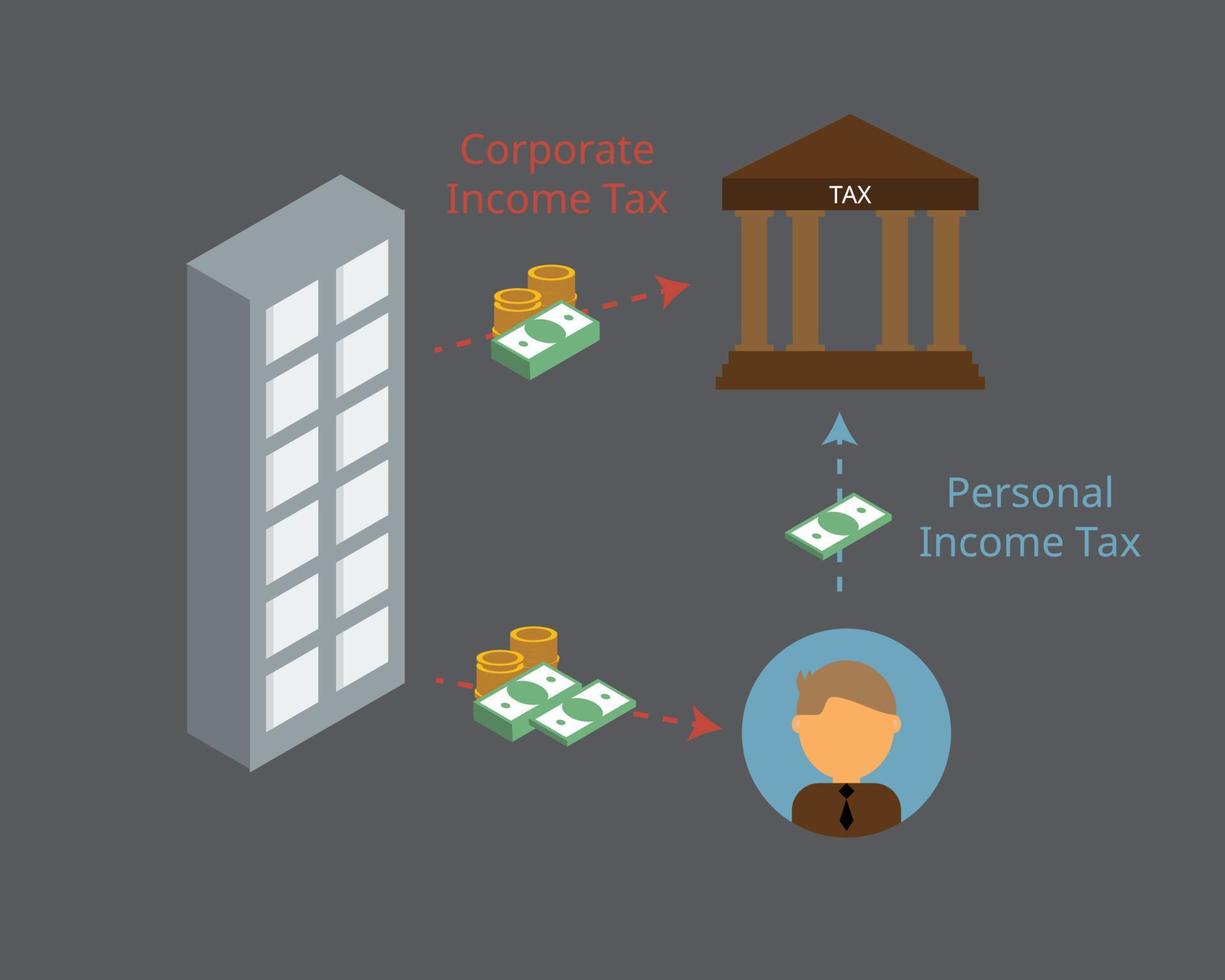

- Personal Income Tax: Tax imposed on individual earnings, such as salaries, wages, and investment income.

- Corporate Income Tax: Tax levied on the profits earned by corporations.

2. Who Pays Personal Income Taxes?

a. Individuals and Households

Personal income taxes are paid by individuals and households. This includes everyone from employees earning wages to freelancers and self-employed individuals.

b. Tax Brackets and Rates

The U.S. employs a progressive tax system for personal income taxes. This means that as individuals earn more money, they move into higher tax brackets, facing higher rates on their income. For example, a single filer earning $50,000 may pay 12% on their income, while someone earning $200,000 will pay a higher rate on the income exceeding the lower bracket threshold.

c. Deductions and Credits

Individuals can reduce their taxable income through various deductions (like mortgage interest and student loan interest) and credits (like the Earned Income Tax Credit). These reductions help lower the overall tax burden.

3. Who Pays Corporate Income Taxes?

a. Corporations and Businesses

Corporate income taxes are paid by incorporated entities, including C corporations, S corporations, and limited liability companies (LLCs) that opt to be taxed as corporations. These taxes are based on the net profits a company generates during the tax year.

b. Tax Rates for Corporations

Corporate tax rates are typically flat, meaning all profits are taxed at a specific rate rather than through a tiered system like personal income tax. As of 2023, the federal corporate tax rate is 21%, which applies to profits over $0. However, states may impose additional taxes that vary based on location.

c. Deductions for Corporations

Similar to individuals, corporations can deduct business expenses to lower their taxable income. Common deductions include salaries, rent, utilities, and depreciation on assets.

4. Key Differences Between Personal and Corporate Income Taxes

a. Tax Structure

- Personal Income Tax: Progressive tax structure with multiple brackets, where tax rates increase as income rises.

- Corporate Income Tax: Typically a flat tax rate applied to net profits.

b. Taxpayers

- Personal Income Tax: Paid by individuals and households.

- Corporate Income Tax: Paid by incorporated entities and corporations.

c. Deductions and Credits

- Personal Income Tax: Individuals can claim personal deductions and credits that reduce taxable income.

- Corporate Income Tax: Corporations deduct business expenses, and the tax benefits differ from personal deductions.

d. Impact of Double Taxation

Corporate income can be subject to double taxation. When a corporation earns profits, it pays corporate income tax. Then, when those profits are distributed as dividends to shareholders, those dividends are taxed again at the individual level. This does not happen with personal income tax, where income is only taxed once.

5. Filing Requirements and Deadlines

a. Personal Income Tax Filing

Individuals typically file their personal income tax returns using Form 1040. The deadline for filing is usually April 15, though extensions may be granted under specific circumstances.

b. Corporate Income Tax Filing

Corporations file their tax returns using Form 1120. The deadline for corporate tax returns is also April 15, but corporations can file for an extension, giving them until September 15 to submit their returns.

Conclusion

In summary, understanding the differences between personal and corporate income taxes is crucial for anyone involved in earning income or running a business. While both tax systems serve the purpose of funding government services, they have distinct structures, tax rates, and filing requirements. By grasping these differences, you can make more informed financial decisions, whether you’re managing your personal finances or running a corporate entity.

FAQs

- What is the primary purpose of income taxes?

Income taxes fund government services, infrastructure, and public programs. - Are personal income tax rates higher than corporate tax rates?

It depends on the income level; personal income tax rates are progressive, while corporate tax rates are generally flat. - Can individuals claim business expenses on their personal tax returns?

Self-employed individuals can deduct business-related expenses on their personal tax returns. - What happens if a corporation doesn’t pay its taxes?

The IRS can impose penalties, interest, and may pursue legal action to collect unpaid taxes. - Are dividends taxed at a higher rate than regular income?

Yes, qualified dividends may be taxed at a lower capital gains rate, while non-qualified dividends are taxed at ordinary income tax rates. - Do all businesses need to pay corporate income tax?

Not all businesses are taxed as corporations; sole proprietorships and partnerships report income on personal tax returns. - What forms do individuals and corporations use to file taxes?

Individuals typically use Form 1040, while corporations file using Form 1120.